With more than 1,360 GW of offshore wind currently in development globally, countries around the world are betting on offshore wind energy to help decarbonize both their electricity supply and industrial sectors. Integrating this rapidly increasing share of renewables into the onshore energy system requires governments to consider new ways to balance energy supply and demand, not only in terms of magnitude but also at specific times and locations. Maintaining a reliable energy system requires a combination of system integration solutions. Some examples include:

- Increased flexibility in energy demand

- Coordination of major demand center locations

- Grid reinforcement to increase capacity

- Increased interconnectivity between countries to distribute power internationally

- Energy storage

- Conversion to alternative energy carriers to decarbonize hard-to-abate industry sectors.

To address the challenges related to integrating offshore wind power, governments are starting to build criteria into offshore wind tenders, requiring project developers to provide system integration solutions. These solutions will support further electrification of industries by stimulating new renewable electricity demand while reducing grid congestion. Particularly in European countries such as the Netherlands, governments now expect winning bidders to take a comprehensive approach to integrating offshore wind supply into the onshore energy system.

Systems integration tender criteria

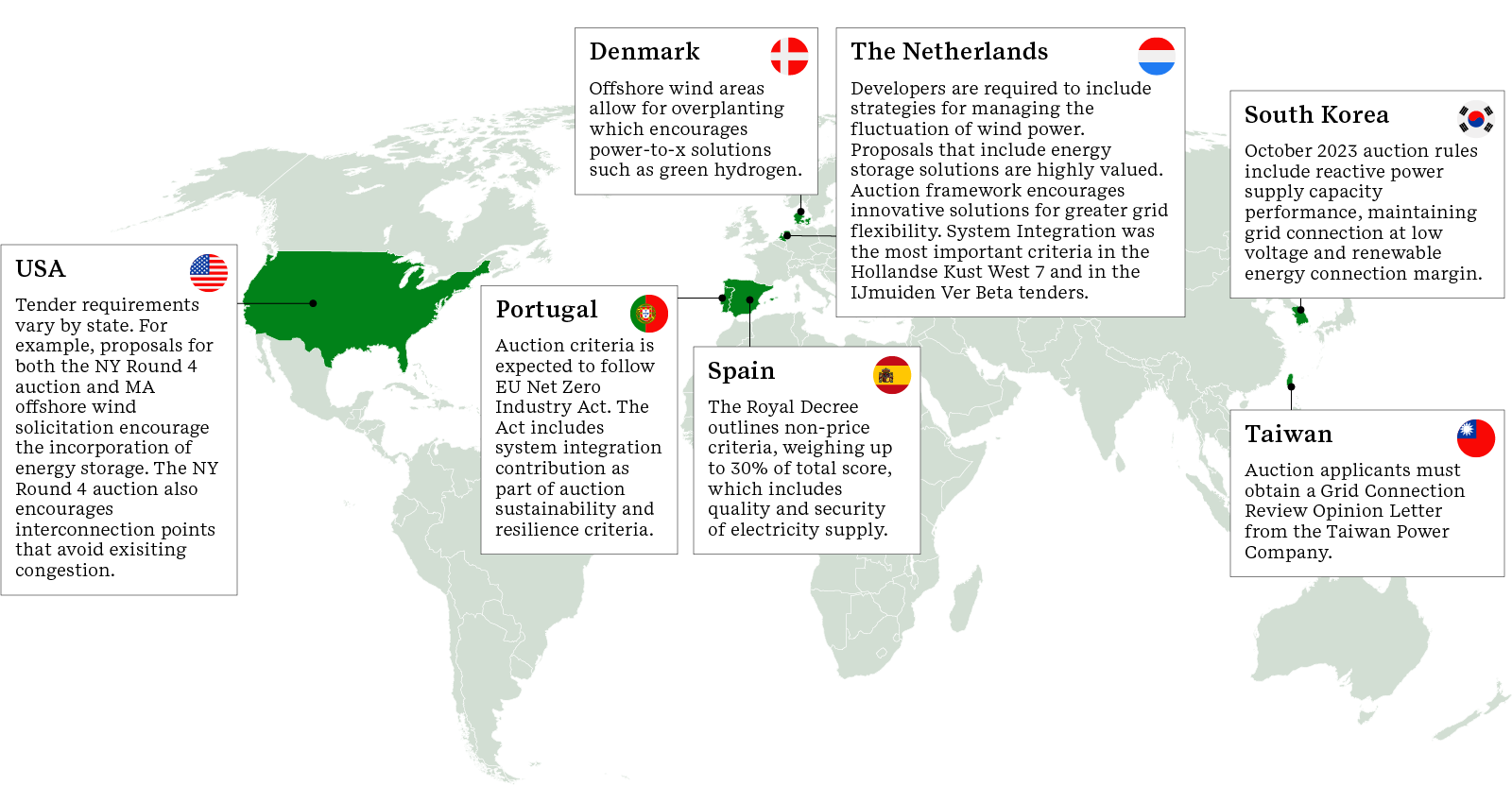

Globally, non-price criteria are gradually being introduced into offshore wind auctions. As the offshore wind industry matures, countries across Europe, Asia Pacific and the Americas are increasingly using sustainability-related metrics such as systems integration, circularity, biodiversity and use of local suppliers to determine offshore wind permit winners.

Figure 1: Chart showing emerging non-price criteria in offshore wind tenders

Source: ERM analysis

We are likely to see further adoption of non-price criteria across European tenders with the introduction of the Net Zero Industry Act 2024. This requires EU member states to set non-price criteria, related to the tender’s sustainability and resilience contribution, cybersecurity, responsible business conduct and ability to deliver projects fully and on time. These criteria will have to apply to at least 30% of the volume, or 6 gigawatts, auctioned every year by a Member State.

Examples of system integration criteria typically used in offshore wind tenders include:

- Development of new industry demand for renewable electricity to absorb the power generated offshore and further decarbonize industry, including hard-to-abate sectors such as steel and concrete. This includes both direct electrification options such as ‘power-to-heat’ and indirect options such as ‘power-to-X’, where offshore wind power is converted to alternative energy carriers, especially hydrogen.

- Increasing the flexibility of demand to better match offshore wind energy supply to onshore demand. Solutions include power purchase agreements (PPAs) with industrial parties, facilitating power demand that follows the characteristics of offshore power generation. These solutions also include the use of storage such as batteries or EV charging.

- Upcoming tenders may also see the introduction of offshore hybrid interconnectors, providing both renewable power infeed and inter-country transmission opportunities.

- Innovation to further stimulate the development of innovative system integration solutions and technologies. Examples include, amongst others, in-turbine or floating offshore hydrogen production and offshore energy storage.

Figure 2: Map showing emerging systems integration criteria in offshore wind tenders

Source: ERM analysis

New business models incorporating system integration

With many countries increasing pressure on industries to reduce their greenhouse gas emissions and requiring competitive offshore wind bids to demonstrate contributions to both efficient system integration and acceleration of industrial decarbonization, it is important for offshore wind developers to develop an integrated project development approach.

Offshore wind developers may approach this in different ways depending on their current capacity and expertise. Some may utilize a strong retail base, focusing on flexible demand solutions in combination with smart energy storage systems. Others may utilize their downstream assets with a stronger focus on power conversion and industrial decarbonization. In all cases, project developers will need to continuously strategize their approach to offshore wind tenders and follow and adapt to the transformation of the energy system.

Example strategies for developers to meet offshore wind tender criteria

Some example strategies to respond to non-price system integration tender criteria include:

Secure viable offtakers. Securing ‘green’ PPAs with local industries is an important way to demonstrate how offshore wind energy will be used without contributing to future grid congestion. For example, Plukon and De Heus, two Dutch companies operating in the food and agriculture industries, signed a PPA to buy electricity from Ecowende, a joint venture between Shell, Eneco and Chubu, that owns the offshore wind farm due to be built at Hollandse Kust West Site VI in the Netherlands. Energy company Vattenfall and steel producer Salzgitter have also entered into a PPA providing electricity from the Nordlicht 1 offshore wind farm to be available for steel production from 2028. Bidders will need either an agreement or strong intent for a PPA before handing in their offshore wind proposals. As grid congestion increases, system integration tender criteria are expected to become stricter, putting stronger demands on the flexible offtake component of PPAs.

Additional demands regarding the location of the offtake relative to the grid infeed are also likely to become more important. To gain an advantage over competitors, developers will need to engage early to find opportunities to support decarbonization at these localized industrial centers. In January 2024, the European Network of Transmission System Operators for Electricity published its EU Offshore Network Development Plans (ONDPs), the first comprehensive review of existing EU offshore grid capacity and future requirements. Forward-thinking developers will use these plans to determine ways they can include system integration solutions at the onshore points of connection.

Support the development of alternatives to oil-based chemical processes by using power-to-X to create green fuels and feedstock. Synthetic fuels and feedstock such as green hydrogen and ammonia, will be key to decarbonizing hard-to-abate sectors, including steel, aviation, chemicals, marine transport and agriculture. Developing onshore electrolyzers (that convert electricity into hydrogen) is also an effective way to absorb offshore wind energy whilst, if properly located, reducing the load on the grid.

This example is an early demonstration to the offshore wind industry of how power-to-X solutions can provide a competitive edge to developers in the bidding process. Vattenfall and Copenhagen Infrastructure Partners’ recently awarded IJmuiden Ver Beta offshore wind farm will include a new 1GW electrolyzer at the Port of Rotterdam which aims to convert electricity from the 2GW offshore wind farm to hydrogen.

The world's first ‘dynamic’ green ammonia plant, able to connect directly to renewable power and adjust to energy fluctuations, was opened in August 2024 in Ramme, Denmark. It was built by a Danish partnership of Skovgaard Energy, Vestas, and Topsoe, with support from the Danish Energy Technology Development and Demonstration Program.

Innovate to integrate. For offshore wind developers to gain a competitive advantage, putting resources into system integration innovation will be vital.

Offshore technology innovation will be especially needed to lower the levelized cost of energy when developing new wind sites further offshore. Policymakers will expect developers to introduce offshore solutions like energy storage, hydrogen production, solar and hybrid interconnectors to increase and optimize use of capital-intensive subsea cables, which would lie idle for almost 50% of the time if used for offshore wind only.

By joining multi-stakeholder study programs, developers can obtain system integration knowledge to secure tenders around the world. Investing in research and innovation programs across hybrid connection, industrial flexibility and power-to-X are all ways to proactively position for future tenders.

Anticipate structural changes in line with the development of hybrid interconnection. Hybrid interconnectors allow clusters of offshore wind farms to supply power to multiple countries or regions, providing both power in-feed and interconnection functionality. Although most countries do not yet have firm plans to install hybrid interconnectors, reports like the EU ONDPs highlight significant potential for their viability. The trend towards hybrid connection is most apparent in the North Sea, with strong collaboration efforts through, amongst other, the North Seas Energy Cooperation and the North Sea Wind Power Hub program.

In the US, hybrid connection considerations are emerging both at the state and federal level. At the state level, offshore wind solicitations increasingly require bidders to design flexibility into their wind farm proposals, such as the New York and New Jersey requirements for farms to be ‘mesh ready’, ensuring a minimum level of compatibility for future offshore wind transmission network configurations. At the federal level, the US Department of Energy has commissioned studies of cross-state network planning in the Atlantic Ocean, which in turn helps states understand their options when planning individual or joint tenders.

To understand the opportunities and risks with respect to hybrid connection, offshore wind developers should proactively engage and develop strategies to manage both the technological and commercial impacts. Developers will need to adapt their financial models and price assumptions to work in international offshore bidding zones. All the technological, regulatory and market challenges of hybrid connection will take time and investment to navigate. Developers will need to be ready to respond dynamically to the unfolding and uncertain impact of hybrid connectors on offshore wind development.

System integration plays an important role in increasing the penetration of renewable energy into the wider energy system. In addition, with many industrial processes still powered by fossil fuels, the continued electrification of industry will be vital for countries’ decarbonization agendas in the next decade. Planning for and investing in system integration solutions as an integral part of offshore wind farm development will offer developers a competitive edge to win tenders, providing a route to mitigate future price risks and safeguard a longer-term pipeline of offshore wind development.