The test of a first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time and still retain the ability to function.

It’s unlikely that American writer F. Scott Fitzgerald had the sustainability transformation in mind when he wrote his quote. Still, this is precisely what companies must do to survive and thrive during this tumultuous period of sustainability transformation: recognize and navigate multiple truths simultaneously.

The mindsets in most boardrooms are not yet ready to successfully navigate the messy but unprecedented shift toward sustainability that is taking place throughout the business community and its value chains. While the sustainability transformation is gaining speed, companies have responded with ambitious targets and roadmaps. However, things are not moving fast enough: many business leaders still struggle to acknowledge the true scale of the risks and commercial opportunities of the sustainability transformation. They keep treating it as a compliance or risk management issue, trusting limited modifications to the status quo will be enough to weather the storm.

However, as previous systemic shifts have shown, only companies that proactively imagine a new future with new markets come out on top. The recent, and still ongoing, digital transformation created and is creating spectacular opportunities. Still, many incumbent companies underestimated the profound impact of the digital revolution. The winners so far have boldly embraced it, imagined its direction, and leveraged innovation to grow new markets, create value, and boost resilience. The same boldness will define winners in the sustainability transformation.

Companies need to recognize, internalize, and act on diverse facts to get into the right mindset. Many companies are confused by the complexity of sustainability and the endless new topics, frameworks, and rules. And they are right: sustainability is complex, and signals are often mixed and contradictory. Realizing it’s not one or the other can create clarity. Business leaders must face at least four pairs of simultaneous truths.

Figure one

source - Catching the Wave report

1 - Acknowledge that the climate and global ecosystems are under tremendous stress but recognize that their critical decline can also be reversed.

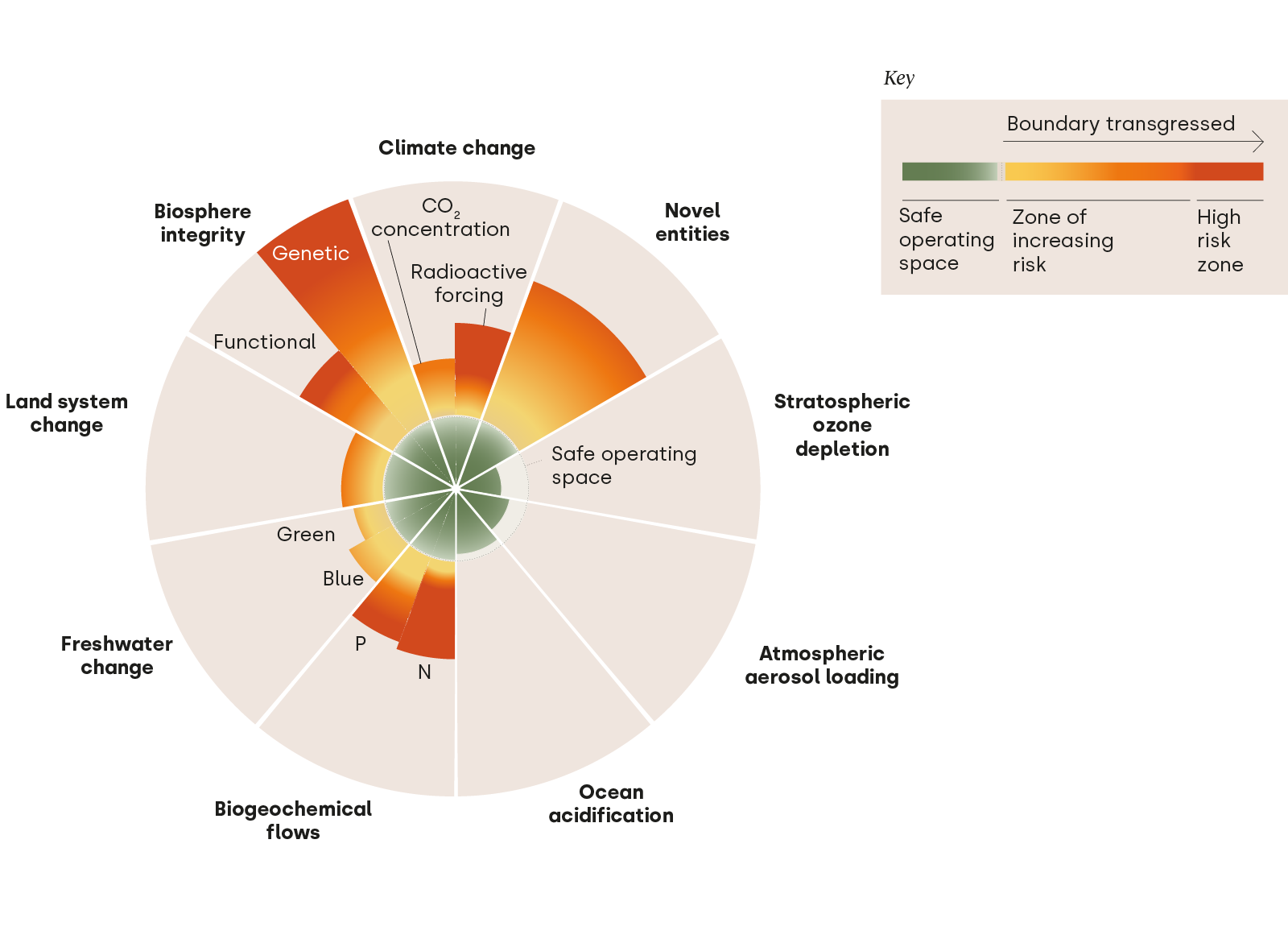

At this point, radical steps will be needed to limit global warming to the 1.5oC target agreed upon in Paris. Ecosystems are also in bad shape. Six out of the nine planetary boundaries are beyond safe limitsi. Disregarding these boundaries has put at least one in ten animal and plant species at risk of extinction and reduced the productivity of a quarter of the planet’s surfaceii. Already disadvantaged regions and communities bear the brunt. Currently climate change alone will likely push more than 100 million people into poverty by 2030iii

But it is also true that less than ten years ago, the world was on track to heat up to around 4°C by the end of the century, an outcome widely seen as catastrophic. Today, the forecast is for 2.8°C of warming by 2100. That’s still insufficient, but we made considerable progress in just a decade. Ecosystem restoration is also surging. More than 100 million hectares globally are currently being rewildediv or restoredv, a trend that will likely be accelerated by the landmark 2022 UN Global Biodiversity Framework. And we can quickly improve inequities if we put our minds to it. The world lifted 1.3 billion people out of extreme poverty in thirty yearsvi.

Figure two - Pushing boundaries

Source: ScienceAdvances (2023). Earth beyond six of nine planetary boundaries

2 - Understand that climate change and destabilized ecosystems are triggering multiple consequences but that solutions capable of tackling those threats are emerging at breakneck speed.

The risk that issues like global warming, nature loss, and food insecurity merge into one devastating crisis is certainly real. The strong correlation between extreme weather risks and extreme poverty, refugee flows, and political instabilityvii is a good example of how individual crises can amplify each other. Although geopolitical conflict and supply chain disruptions draw the most corporate attention, extreme weather already causes over $300 billion in annual economic damage, most of it uninsuredviii.

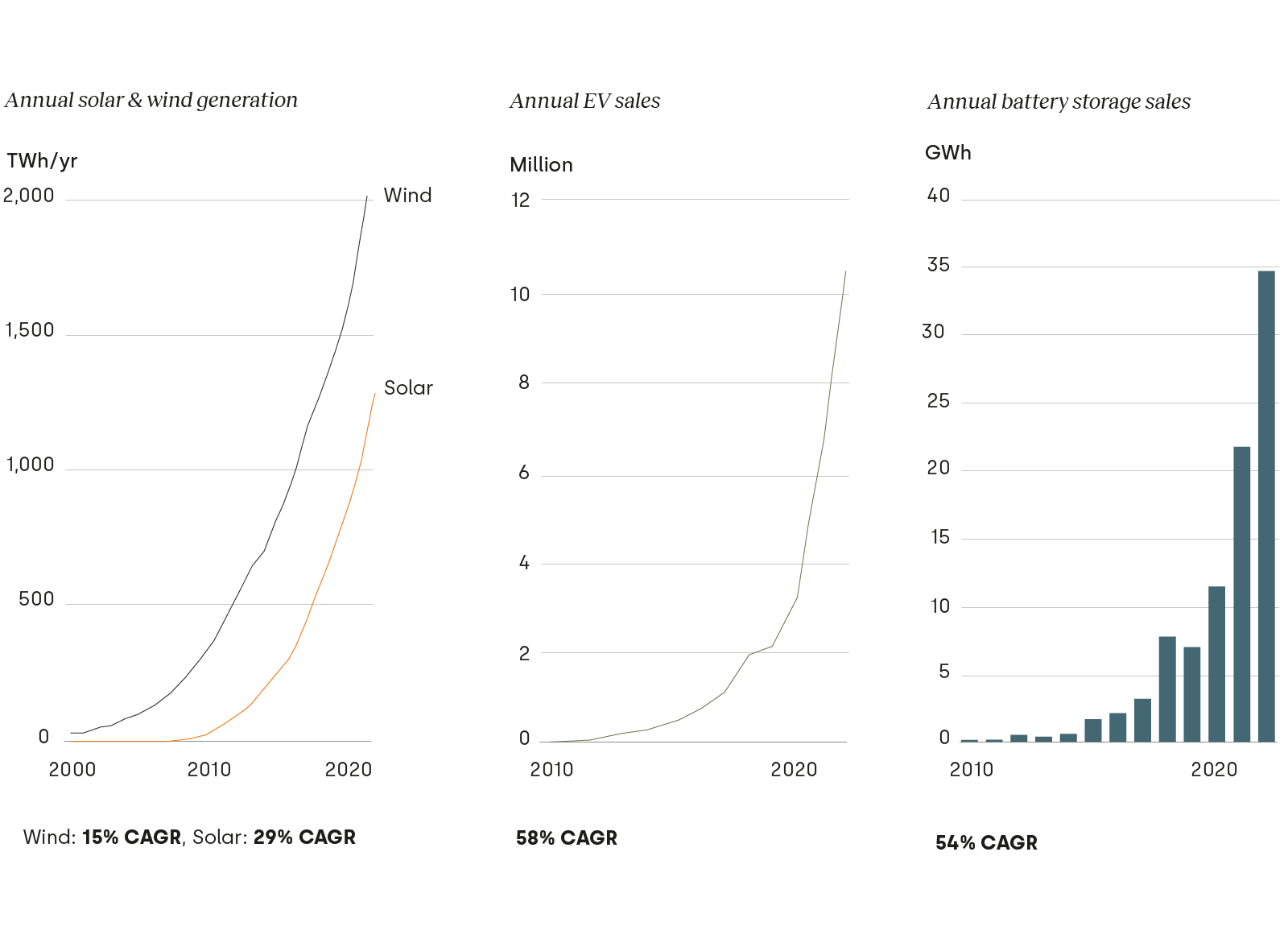

However, innovations and solutions to avoid that outcome are charging ahead, creating new multibillion-dollar markets, like solar, EV, battery storage, and regenerative agriculture. And it is happening faster than even the most seasoned experts imagined. Take EV sales this year, the International Energy Agency (IEA) revised its expected share of EVs in global annual car sales to 50 percent in 2035ix, up from 21 percent in 2035 it predicted two years earlier. The 21 percent share in 2035 it predicted two years earlier. Other markets, like green chemicalsx and green steelxi, are still small but will soon grow as the sustainability transformation follows the same S-curve - from slow to exponential adoption - as previous system transformations.

Figure three - Reaching for the stars

Source: Rocky Mountain Institute (2023). The Energy Transition in Five Charts and Not Too Many Numbers

3 - Appreciate that it takes risk to avoid risk. Resist the natural human inclination to downplay drastic environmental, social, and economic consequences. Instead, recognize that avoiding such outcomes and embracing solutions with huge potential is the best commercial strategy.

Many companies and industries treat sustainability as a compliance or risk management issue, seeing it as a cost of doing business rather than a commercial opportunity. As late as 2022 only one in five executives at large global companies believed that the business case for sustainability was clear. In contrast, 53 percent said they consider sustainability initiatives a financial burden their companies must bear to do businessxii. Companies with compliance mindsets underestimate the sustainability transformation, thinking that minimal sustainability efforts and minor tweaks to the existing business model will be sufficient to safeguard commercial success.

This lack of corporate imagination overlooks the commercial opportunity of a lifetime. The shift from a fossil fuel-based economy to a net-zero economy will require historic levels of investment, similar to the reconstruction of Europe after World War II, creating vast demand for new products and services. Estimates on the capital needed to achieve net zero by 2050 range from $100 trillion to more than $275 trillionxiii. The good news is that senior executives are starting to recognize this: in 2024 half of large global companiesxiv say that the biggest strategic impact of sustainability they foresee is on their long-term value creation.

Of course, seeing it and translating it into action are two different things. As in previous transformations like the digital revolution, the first movers will be the winners. For example, Microsoft became one of the world’s most valuable companies by imagining a new future with novel markets before they fully materialized. Or digital survivor Samsung, which decided that innovative design, not imitation electronics, was its future. It reinvented itself as the world’s largest smartphone and memory chip producer and is ready to surf the artificial intelligence wave.

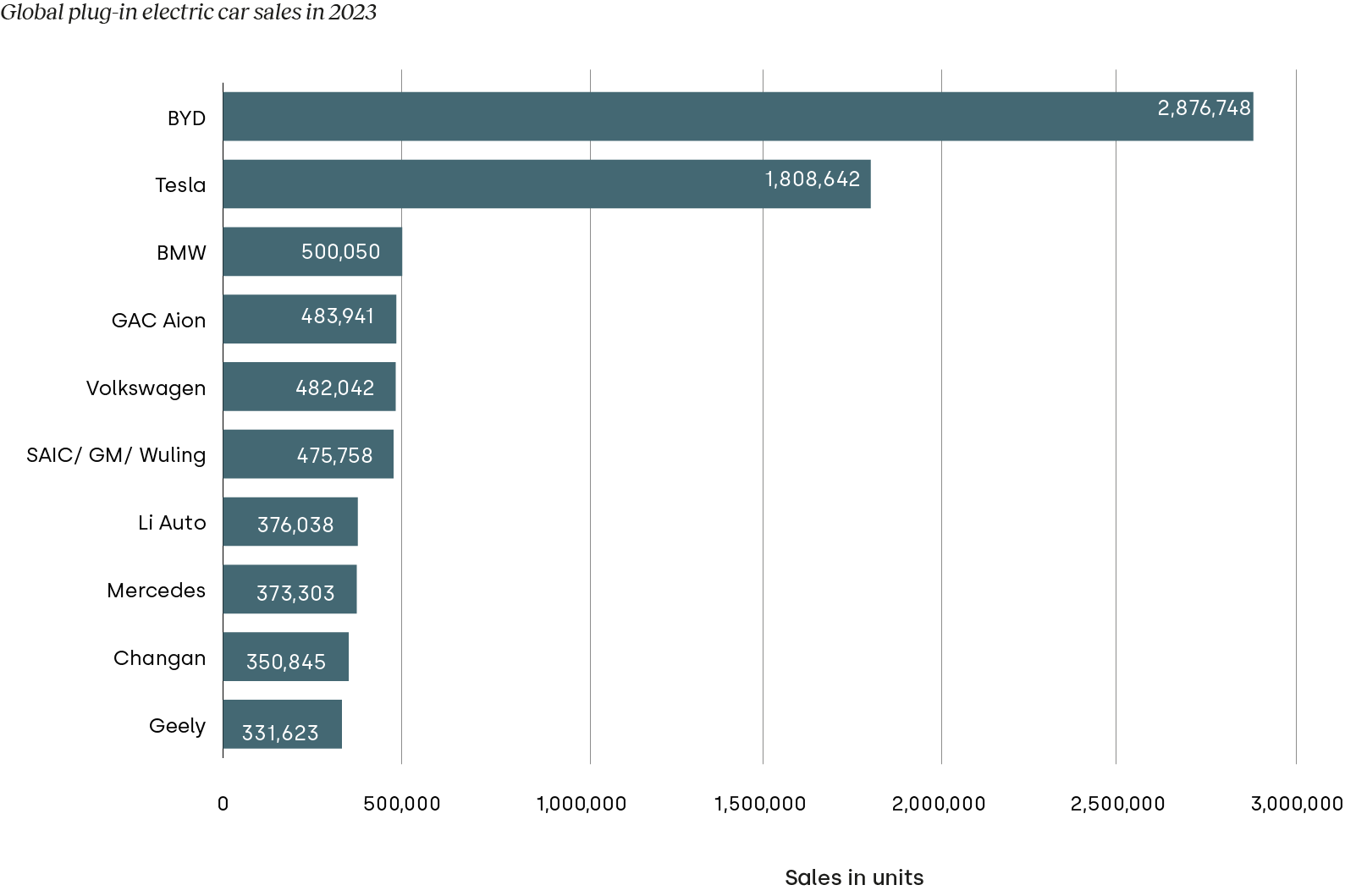

Similarly, Tesla and BYD imagined the enormous potential of electric vehicles early on. Global EV sales jumped from 320,000 in 2014 to 14 million in 2023. Thanks to their foresight, the companies hold a combined global market share of 33 percentxv. Imagination has paid off for 190-year-old Schneider Electric as well. The company reports its revenues have tripledxvi since it shifted its focus to maximizing energy efficiency and renewable electricity access for clients.

Figure four - Plug in early

Source: Statista (2024). Estimated plug-in electric vehicle sales worldwide in 2023 by brand

4 - Internalize that new markets need game-changing innovation. Bold experimentation is hard to foster but is also key to seizing the commercial opportunities of the sustainability transformation. An open, innovative culture is unleashed when senior leaders openly encourage and support creativity within the entire organization.

A radically altered future depends on sweeping product and business model innovation. Still, at many companies, fear of criticism, fear of uncertainty, and fear of hurting one's career are significant barriers to innovation and lead to a risk-averse approach to innovation. Employees at average or below-average innovators are two to four times more likely to be held back by one of these fears than those working for the most innovative companies. Risk intolerance also leads to an overfocus on incremental innovation of core products and services at the cost of the radical innovation needed to bolster business continuity during transformative change.

Companies with risk-averse innovation strategies ignore the lesson that only a culture of bold experimentation generates the radical innovation needed to seize commercial opportunities in times of turmoil. The winners of the digital revolution did not wait until the dust settled, nor did the early winners of the sustainability transformation. An imaginative CEO fanning an innovative culture and framing radical innovation as business critical is an important asset: at eight of the ten top innovators in the S&P 500, the CEO was the innovation catalyst, compared to 17 percent at averagely innovative companiesxvii.

CEO support emboldens the rest of the organization. In a global survey on innovation, employees of top innovators were 11 times more likely than those at other organizations to say that their organizations incentivize risk-taking and five times more likely to report being encouraged to experiment. And it pays off: the most innovative companies in the S&P Global 1200 index are at the forefront of both ESG and digital innovation and were responsible for $9.3 trillion xviii, or nearly half, of the index’s value creation between 2018 and 2023.

In conclusion, facing and internalizing multiple truths is the only way for companies to navigate the sustainability transformation successfully. Yes, the threat of social and environmental crises amplifying into one devastating crisis is real, but so are the solutions exponentially charging ahead. Yes, it is tempting to downplay the scale of the sustainability transformation. However, previous systemic shifts show that companies that recognize and embrace them are poised to win. What set the winners of previous transformations, like the digital revolution, apart was not superior knowledge. It was the fact that they confronted simultaneous truths head-on and boldly acted before things were clear, while companies that played it “safe” withered or disappeared. The sustainability transformation will not be any kinder to reluctant movers.

This blog is based on a chapter in our recent report “Catching the Wave – Seizing the opportunities of the sustainability transformation”.

Catching the wave

Seizing the opportunities of sustainability transformation

i - Katherine Richardson et al. (2023). Earth is beyond six of nine planetary boundaries. Sciences Advances.9, 37. Retrieved from here.

ii - United Nations Sustainable Development (2023). UN Report: Nature’s Dangerous Decline ‘Unprecedented’; Species Extinction Rates ‘Accelerating.’ Retrieved from here.

iii - World Bank (2020), Revised Estimates of the Impact of Climate Change on Extreme Poverty by 2030. Retrieved from here.

iv - Explorer.Land (2023). Global Rewilding Alliance. Retrieved from here.

v - IUCN (2022). IUCN Restoration Barometer. Retrieved from here.

vi - Our World in Data (2019). Poverty. Retrieved from here.

vii - International Displacement Monitoring Center (2023). Internal displacement and food security. Retrieved from here.

viii - AON (2023). Weather, Climate, and Catastrophe Insight. Retrieved from here.

ix - S&P Global (2024). IEA sees electric car boom displacing up to 12 million b/d of oil by 2035. Retrieved from here.

x - Precedence Research (2023). Green Ammonia Market - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2032.Retrieved from here.

xi - Precedence Research (2023). Green Steel Market - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2032.Retrieved from here.

xii - Capgemini Research Institute (2022). A world in balance: why sustainability ambition is not translating into action. Retrieved from here.

xiii - Bank of America Securities (2023). The $275 trillion business opportunity. Retrieved from here.

xiv - Morgan Stanley (2024). Companies see sustainability as integral to long-term value creation. Retrieved from here.

xv - Statista (2024). Plug-in electric vehicle sales worldwide by brand 2023. Retrieved from here.

xvi - Schneider Electric (2023). 2022 Sustainability Report. Retrieved from here.

xvii - McKinsey & Company (2022). Fear factor: Overcoming human barriers to innovation. Retrieved from here.

xviii - Boston Consulting Group (2023). The New Blueprint for Corporate Performance. Retrieved from here.