Estimates of the financial impact of climate change by 2050 put the delivery cost of the low-carbon transition at around $110 trillion globally, while damages from physical climate change could amount to $38 trillion per year by 2050. While these global estimates provide a macro picture of economic impact, determining climate and transition impacts on individual companies requires an analysis that incorporates the specific characteristics of the climate-related risks and opportunities that are relevant for the company context.

With the emergence of climate-related disclosure standards such as the Integrated Financial Reporting Standards (IFRS), the European Union’s Corporate Sustainability Reporting Directive (CSRD), and the U.S. Securities and Exchange Commission’s (SEC) proposed climate-related disclosure rule, organizations in nearly all jurisdictions will be required to quantify their climate-related financial impacts and risks. While many of these standards follow the path the Task Force on Climate-related financial Disclosures (TCFD) started back in 2017, their intricacies are likely to complicate corporate adoption.

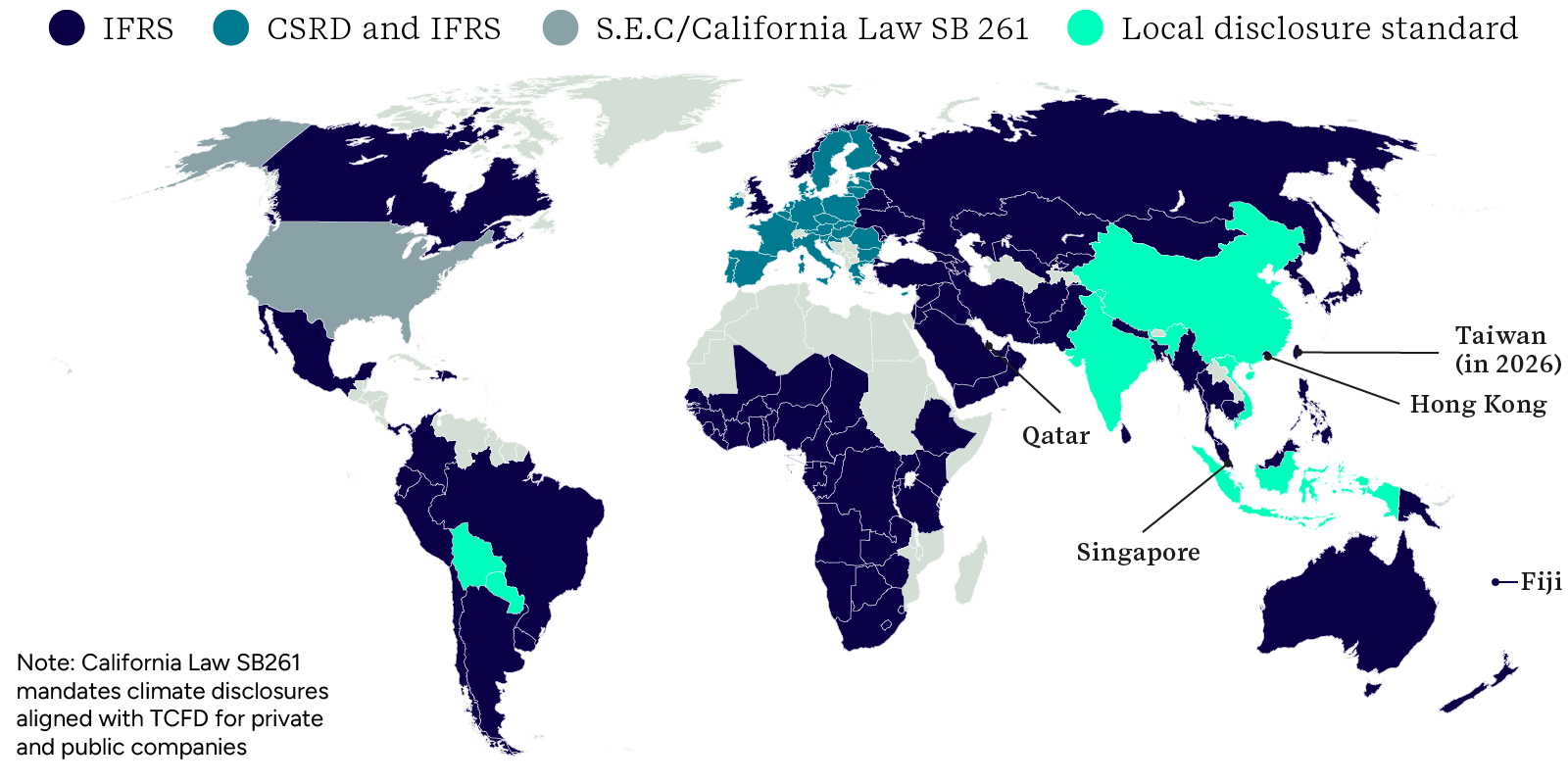

Key climate-related disclosure standards globally*

*Note that other relevant standards are applicable in key economies around the world, including China, India and others, as shown in the map below.

Climate regulations: A (nearly) global mandate

Climate-related disclosure regulations by region.

Around the world, key regulatory developments, such as the IFRS and CSRD have already led to a step change in the breadth and depth of climate disclosures. Going forward, companies in nearly all countries will be required to comprehensively assess the financial impact of climate change on their business and disclose the results within their financial statements. These disclosures will focus on climate change’s impact on a company’s

- The current reporting period – i.e., present financial effects; and

- Short, medium, and long-term timeframes – i.e., anticipated financial effects.

|

Responding to regulations presents challenges

Climate-related financial quantification is not a new process. Companies reporting to Carbon Disclosure Project (CDP) have long been required to disclose potential financial impact figures for any risks or opportunities with a ‘substantive financial or strategic impact’ to be awarded top scores. However, the detail of these mandates and their requirements to integrate quantification into financial reporting are unfamiliar for most companies, creating a new set of challenges. Through ERM’s experience supporting organizations across sectors with their financial quantification assessments, we have observed the following challenges.

Identifying climate-related issues which may present a material financial risk

The challenges associated with responding to regulations can be sizeable, however undertaking the process in a structured, step based approach can mitigate them. Climate-related financial impacts are not always clear or direct, and, for many companies, identifying the driving issues, assessing potential impacts, and determining the material topics to include in financial reporting may be challenging. Even after a comprehensive and quantitative climate risk and opportunity assessment, companies will have to make a judgement call on which risks and opportunities they deem material for disclosure.

For most companies, financial quantification will not be their first experience conducting forward looking assessments, with many having conducted a qualitative scenario analysis as the Taskforce on Climate-related Financial Disclosures recommended. Still, the complexity of a quantitative assessment may mean that companies opt to pilot financial quantifications on a limited number of climate-related risks or opportunities. To identify what those risks and opportunities are, companies draw on existing analyses (such as risk assessments, etc.), to review the potential impacts of climate-related issues, including any past or ‘realized’ impacts. Issues that companies often face during this process include:

Engaging relevant stakeholders and gathering necessary data inputs

After identifying potentially material climate issues, the next key step is comprehensive data gathering and stakeholder engagement. ERM has developed a methodology to quantify climate-related risks and account for key elements of disclosure requirements. As we developed this approach, we identified three steps which are critical to establishing a strong foundation for effective financial quantification.

The emergence of climate-related disclosure standards means many companies will be required to quantify their climate-related financial impacts and risks. However, there are many challenges associated with this process, including:

- Lack of guidance within regulatory frameworks on financial quantification

- Data collection difficulties.

- Need to provide meaningful, tangible results for the company.

- Complexity of climate disclosure frameworks and regulatory requirements

To prepare for climate-related financial quantification, companies should pursue the following actions:

- Structuring the effort from the outset to ensure outputs produce clear and tangible insights.

- Engaging relevant stakeholders to ensure all relevant views are accounted for.

- Preparing data inputs to ensure the best available data is being used for the quantification.

Moving on from preparation, the second blog in this series will focus on delivery. Specifically, the specific steps and approach that companies need to conduct the financial quantification of climate risks and opportunities successfully.

Our follow-up blog on this subject, From Mandate to Mastery: Delivering on financial quantification requirements, goes into more detail.