One familiar yet true rule determines corporate focus: what gets measured in monetary terms gets managed. Climate-related action offers ample opportunities to drive revenue and enhance the commercial resilience of companies. However, like any commercial opportunity or risk, the commercial upsides of climate-related action will only attract management attention and capital if they are robustly quantified.

Quantification helps visualize the full benefits of climate action

The good news is that senior executives are increasingly recognizing the potential of climate-related actions to mitigate risks, save costs, and generate or protect revenue. For example, a recent executive survey found that 50 percent of business leaders cited reduced costs and sales growth as key benefits of their sustainability actions.

Additional evidence suggests that climate-related focus can drive innovation, increase market share, and lead to higher profits. In the U.S., nearly 20 percent of all consumer-packaged goods (CPG) are marketed as sustainable, with an annual growth rate that is one-third higher than conventional alternatives. And despite cost-of-living pressures, many consumers say they are willing to pay a premium of almost 10 percent for those sustainable products.

However, companies let much of this potential slip away because they conduct limited and mostly qualitative assessments of the costs and benefits of climate-related efforts. This likely leads to a substantial underestimation of the costs and missed revenues associated with inaction, especially in the medium to long term.

To illustrate, over 95 percent of S&P 500 companies publish sustainability reports. However, just a handful of them tie their sustainability actions to their strategy and growth targets, leaving investors guessing about the impact of these sustainability investments on financial performance.

Increasing scrutiny of investments in climate-related risks and opportunities further underscores the urgency of translating them into quantifiable business cases. Demonstrating the value-creating potential of climate-related action is the best —and likely only —way to maintain progress on corporate sustainability ambitions.

Current focus on the short-term creates blind spots

Companies have become more adept at assessing and implementing climate-related actions that yield immediate financial benefits, such as cost savings through energy efficiency measures or cost avoidance through regulatory compliance. For example, replacing incandescent lights with LED can save 75 percent in annual energy costs, while the price of LED lights has plummeted, presenting an easy, immediate way to make the CFO happy. Companies are also improving their ability to assess and mitigate relatively short-term risks, for example, by complying with and monitoring trends in disclosure regulations or running climate scenarios to determine how a USD 50/ton carbon tax in 2030 would impact their costs.

However, many companies fall short in quantifying the avoided costs and benefits of climate actions that mitigate long-term risks or generate long-term cost savings, which is significantly more complex. The trickiest and least developed area in this regard is the financial quantification of revenue-generating or market share-protecting opportunities related to the development of new sustainable products and services.

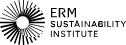

Figure 1: Thinking ahead - Climate-related areas with value-creating or risk-mitigating potential

There is no doubt that quantifying long-term risks is challenging. However, not investing serious effort in doing so will result in an incomplete financial picture of the actual risks businesses face and the commercial opportunities they might miss. For example, a recent study suggests that corporate climate risk assessments rely on simplified data, largely overlooking the long-term financial impacts of supply chain disruptions, physical climate damage, and resource scarcity. Due to these omissions, companies may underestimate their financial exposure to negative climate impacts by as much as 70 percent.

Failing to quantify long-term commercial opportunities to create value can be equally damaging. Developing sustainable products is not just about attractiveness to investors or (sometimes elusive) price premiums, but, most importantly, about capturing specific market segments and growing overall market share.

Not quantifying for the long term also hinders the types of innovation required to break into new sustainability-related markets. If companies hesitate too long, more assertive competitors may develop technological and cost advantages that are hard to catch up with. The de facto Chinese dominance in markets such as electric vehicles (EVs), solar, and batteries should give senior executives pause. For example, Chinese EV maker BYD is now the best-selling electric vehicle in Europe, despite the tariffs Europe implemented to shield its domestic car makers

From opportunity identification to business case quantification

Companies should employ a two-step process to gain a quantitative understanding of relevant climate-related risks and opportunities: first, identify them through transition planning, and then activate business cases through quantification.

Climate transition plans and financial quantification go hand in hand, each reinforcing the other. A robust transition plan, underpinned by high-quality climate performance and climate-related commercial data and aligned with the company’s strategic priorities, is crucial for identifying material climate-related risks and opportunities that a company should focus on.

Companies can rely on an excellent template to execute their transition planning process, developed by the British Taskforce for Transition Planning (TPT). Their framework has evolved into the gold standard for transition planning. TPT’s approach is also aligned with IFRS 2, the disclosure framework developed by the International Sustainability Standards Board (ISSB), which requires companies to disclose the anticipated financial effects of climate-related risks and opportunities.

To make the transition plan actionable, the material opportunities and risks it generates need to be translated into quantified business cases. It’s crucial to adhere to regular corporate finance methodology and metrics as much as possible, for example, using well-researched cash flow projections and internal rate of return (IRR) to assess and compare the attractiveness of climate-related investments.

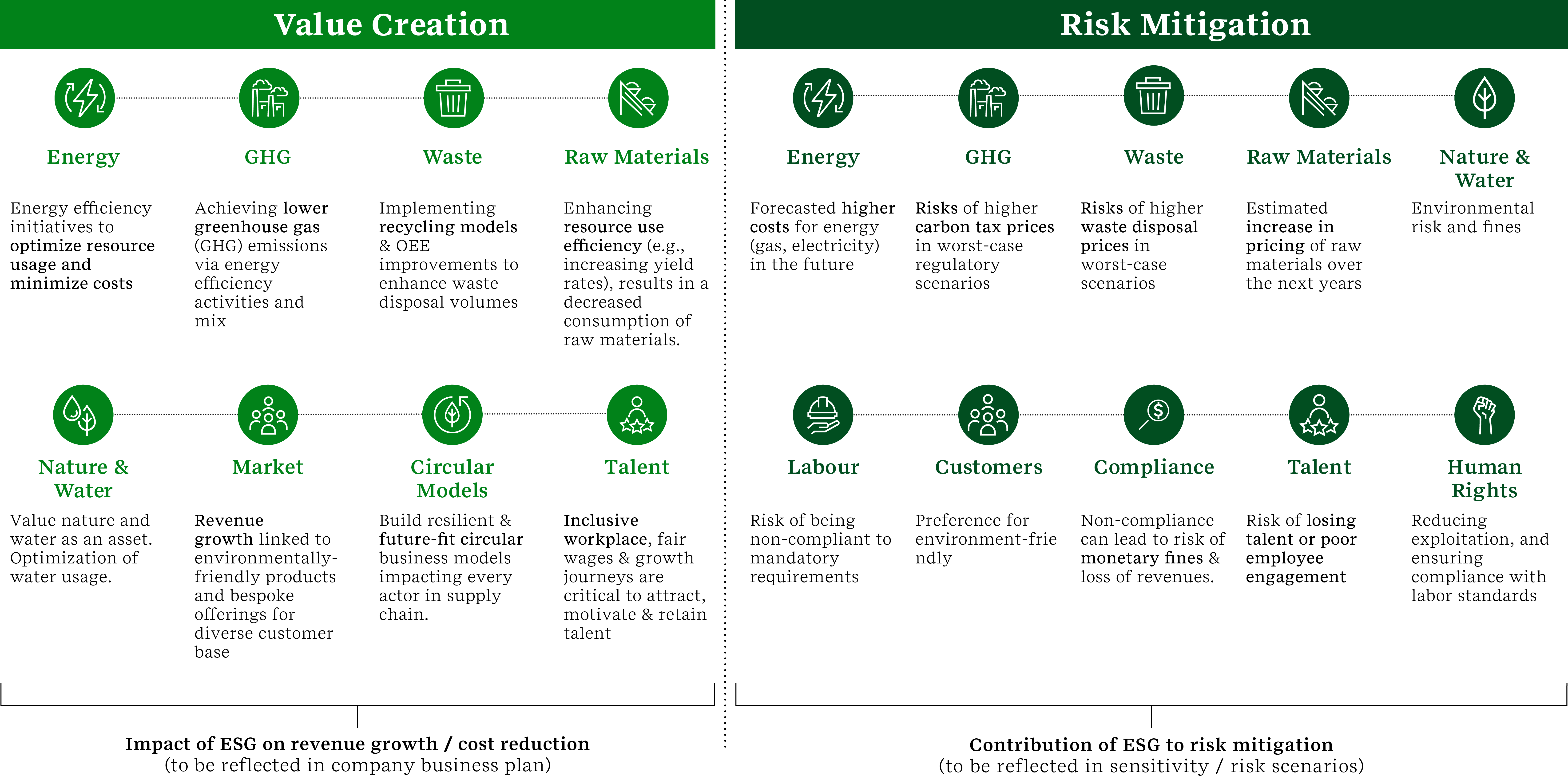

Figure 2: Calculated approach - Financial value of climate-related risks and opportunities

Sources: ERM Calculations

Sources: ERM Calculations

The payoff: more value creation, capital, and focused advocacy

The use of regular corporate finance practices to quantify climate-related opportunities and risks ensures that business cases are valued in a universal language that all crucial parties for success, from internal corporate finance departments to banks and investors, instantly understand. Methodical identification and standardized quantification of climate-related business cases pay off in several important ways.

- Management buy-in for decisive action: Quantifying material risks and opportunities identified through transition planning makes the costs and missed revenues of inaction concrete for senior executives, supporting the integration of sustainability into the core strategy. It also creates a clear internal rationale for corporate investment in the strongest business cases for risk avoidance and revenue-generating or protecting opportunities, both in the short and long term. Enhanced revenues, either through expanding and protecting market share or innovations that open new climate-related markets, will likely be the biggest beneficiary of consistent quantification.

- Improved access to (cheaper) capital: Few substantial corporate investments get off the ground without access to external capital. Robust, corporate finance-style quantification of climate-related business cases opens several doors. First, it helps attract the attention of financial-metrics-driven commercial investors. Although this group has no specific interest in climate-related opportunities, they will happily provide capital if the financial metrics fit their criteria. Careful quantification also lowers the cost of capital by expanding access to preferential financial instruments, such as green and sustainability-linked bonds. Finally, a convincing monetary assessment of climate-related risks can lead to an overall cost of capital discount, because it gives potential investors confidence that a company has those risks well-covered.

- Effective policy influencing: Quantification also reveals potential actions that could limit material climate risks or tap into unmet demand for sustainable products, but are currently too costly to execute. For example, many automotive companies would buy green steel if it were available at a low enough price. However, the current green steel price is too high to attract a sufficient number of customers. Quantifying the gap to a positive business case can help companies or sectors to successfully advocate for the mix of government policies, such as mandates, carbon levies, or subsidies, needed to close it.

Roadblocks: lack of primary data and universal methodology

Despite the numerous advantages of quantification, the foundational elements necessary for successful execution remain underdeveloped. Some suboptimal circumstances can be addressed at the company level, while others will require concerted, multinational efforts to resolve. Among the multiple roadblocks, two stand out.

- Data gaps and quality: Good quantification is built on good data, but companies often struggle to obtain reliable data on key metrics such as climate exposures at the asset level, environmental impacts in financial terms, or Scope 3 emissions. For example, assessing physical climate risk requires granular primary data for each facility, something which most firms don’t have. The overly simplified or proxy data that many companies currently rely on is insufficient and often leads organizations to underestimate their actual exposure.

- Fledgling standardization: Unlike traditional financial accounting, which is highly standardized, sustainability quantification is still evolving. How, for instance, do you put a monetary value on biodiversity loss or the future benefit of an early investment in carbon capture technology? This lack of universally accepted methodologies creates inconsistencies and complicates comparability. However, the situation is improving, with frameworks from the Taskforce on Climate-related Financial Disclosures (TCFD) and the International Sustainability Standards Board (ISSB) increasingly providing guidance. Still, the lack of a robust universal methodology is not a reason to postpone investing in quantification. Existing corporate finance methodologies can be modified, and time-tested techniques, such as cash flow projections based on client surveys and expert interviews, can be utilized to develop climate-related business cases necessary for progress now.

One thing is clear from the past year: showing how climate-related action can create value is crucial for sustaining progress on corporate sustainability. To succeed, companies need to view climate-related risks and opportunities through a purely financial and data-driven lens, rather than relying on qualitative assessments. This approach enables companies to identify material issues and opportunities and prioritize those with the highest value by applying corporate finance techniques to quantify their business cases. Quantification provides a universal language to set climate-related value creation in motion, visualizing the costs and missed revenues of inaction, encouraging corporate managers to act, and increasing access to capital. Using climate-related quantification will move sustainability from the fringes to the strategic core.