PFAS (per- and polyfluoroalkyl substances) present complex and cross-functional risks to companies, spanning their entire operational footprint, product life cycle, and strategic enterprise.

Companies that underestimate the breadth and materiality of PFAS risk within their organizations are exposed to costly and perhaps existential business disruptions, such as reputational or brand damage, lost market share and eroded shareholder value, broken supply chains, environmental liabilities and legal claims.

To avoid these types of costly surprises, companies need to go beyond a reactive, compliance-based approach and move to a more strategic, integrated PFAS risk management approach that is aligned with their corporate enterprise risk management program.

What makes PFAS a key business risk?

Ubiquity - PFAS, a class of over 10,000 synthetic organic chemical compounds, have been in use since the 1940s. Due to their chemical properties, PFAS were, and continue to be, used in a wide range of applications and industries, including textiles and household goods, cosmetics and personal care products, electronics and high-tech applications, pharmaceuticals and medical devices, and many others. As a result, most companies have PFAS in their historical and possibly their current supply chains, although many may not be aware of this fact due to the opacity of product information and PFAS-related data.

PBT Concerns - PFAS are often referred to as ‘forever chemicals’ because they are extremely resistant to environmental and metabolic degradation. Additionally, some PFAS have been found or are suspected to cause adverse human health effects, such as an increased risk of cancer or immune system impacts. While PFAS may vary in persistence, tendency to bioaccumulate, and toxicity, as a class of compounds they are often considered as persistent, bioaccumulative and toxic (PBT).

Social, political and regulatory pressure - The PBT concerns and apparent ubiquity, both in the supply chain and the environment, have driven a rapid increase in social and political pressure for transparency with respect to PFAS use and to remove PFAS from products, operations and the environment.

In response to these pressures, regulatory agencies at local, state, national and regional levels are establishing broad, and often disparate restrictions on the use and sale of PFAS-containing materials. Additionally, regulatory agencies are setting environmental clean-up levels and advisory levels for PFAS that are extremely low (parts per trillion levels). These bans and low levels mean that even the slightest amount of PFAS can create material business risk, such as product restrictions in certain markets or environmental cleanup liabilities.

Add to these drivers an increase in shareholder and investor inquiries and pressures, and many companies are scrambling to identify, prioritize and mitigate PFAS-related business risk.

How PFAS may impact your business

Identifying where PFAS-related risks exist within a business and quantifying those risks to facilitate materiality assessments and prioritization requires a combination of technical and regulatory expertise across several disciplines plus detective work.

Understanding where and how PFAS may have entered an operation, and the subsequent fate and transport through the operation or the environment, is critical to identifying where PFAS risks may reside.

PFAS may have been added, intentionally or unintentionally, to products, resulting in potential marketability risks, product end-of-life considerations, and brand reputational risks. Or PFAS may pass through an operation and manifest itself in air emissions, or wastewater, stormwater or solid waste streams, which present both on-site and off-site environmental liabilities that are difficult to both quantify and remediate.

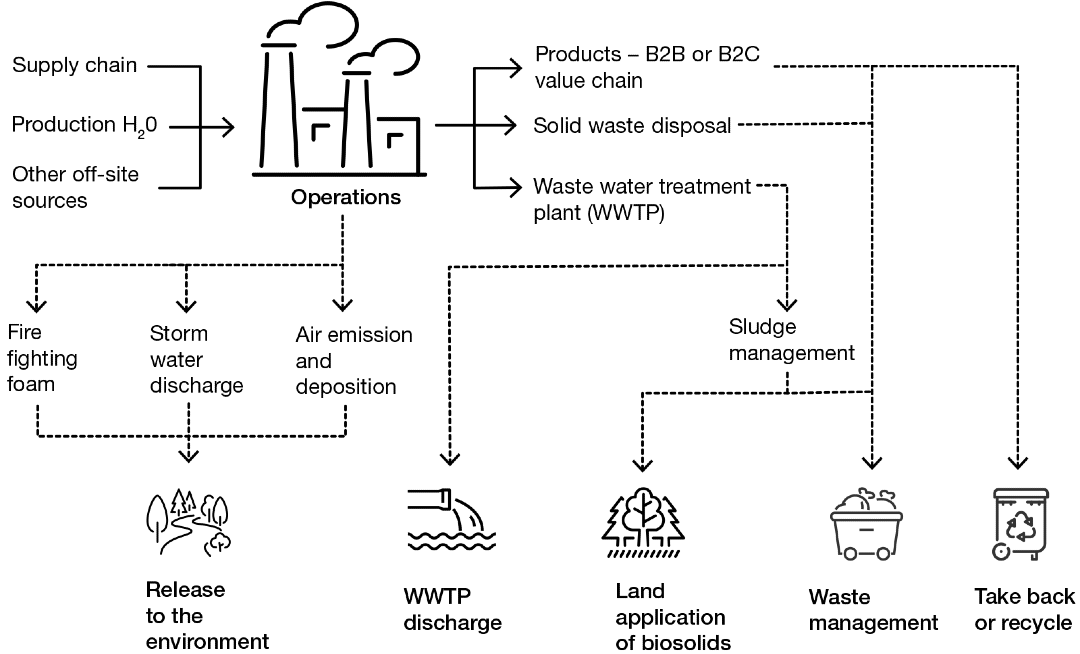

The figure below illustrates a simplified conceptual risk model associated with PFAS, including potential environmental liabilities, loss in market share related to product or value chain impacts and operational risks:

Environmental liabilities – the costs to investigate and remediate PFAS-contaminated soil and groundwater can be significant. Even apparently small releases of PFAS can result in costly environmental liabilities due to the cleanup levels being extremely low and PFAS resistance to chemical, biological and thermal destruction.

Additionally, PFAS can be very mobile once released into the environment, which can result in liabilities extending well beyond one's own property. This can not only add considerable costs associated with investigation and remediation, but also adds complicating factors such as engaging with third party property owners and the community, preparing for and defending against third party claims, and establishing a credible technical basis to differentiate sources of contamination (e.g., forensics to establish background and/or third-party sources).

Regulations requiring the investigation and remediation of PFAS contamination already exist in many jurisdictions, including the EU, Australia and various states in the US, and have or are expected to emerge quickly elsewhere, such as China, Japan and Brazil. The regulations are not consistent, including regarding which PFAS are regulated and what cleanup levels need to be met. Addressing potential third party damages claims can also be costly, as evidenced by recent billion-dollar settlements made by several manufacturers.

Managing environmental liabilities, defending against existing legal claims and avoiding future claims requires technical expertise across various disciplines (e.g., geochemistry, geology, hydrogeology, forensics, toxicology, engineering) and in-depth understanding of the regulatory and legal requirements and opportunities within each jurisdiction.

Reduced Market Share due to product restrictions and consumer preferences – public awareness and adverse perceptions about PFAS have increased rapidly over the last 5-10 years, which influences buying decisions and increases political pressure to regulate and remove PFAS from the supply chain.

Countries and states are implementing sweeping legislation that may restrict or fully close off a market to certain PFAS containing products, such as the recently proposed ban in the EU or state-specific bans in the US (e.g., Maine, California). In many cases, these restrictions or bans are very broad and will impact a wide range of industries, from manufacturing to high tech to energy, and will close or restrict marketability of many products and disrupt supply chains. Further, as regulatory restrictions and public scrutiny increases, both business and public consumers may avoid products that are believed to contain PFAS, leading to product deselection.

License to operate – in addition to product restrictions, countries and states are advancing a wide range of regulations to compel companies to monitor, disclose and control the release of PFAS to the air, water, and land. Companies are required to update or obtain new permits to monitor and manage PFAS in stormwater, wastewater, air emissions and waste disposal. In addition, public and political pressure, including environmental justice concerns, is threatening companies’ social license to operate, and disclosure-related regulations (e.g., Toxics Release Inventory in the US) will shine a spotlight on companies using and emitting PFAS. At a recent industry conference, a US EPA Regional Administrator emphasized the increased focus US EPA will have on environmental justice considerations when evaluating projects, permits and enforcement concerns.

How to address PFAS as a business risk

As public, political and legal pressures rapidly force industries towards a PFAS-free future, companies should focus on tackling the most pressing and material risks to the organization and take a strategic enterprise-wide approach to addressing PFAS:

Recognize the potential material risk posed by PFAS and integrate PFAS as an element into your organization’s enterprise risk management program. Most large, multi-national companies have a corporate enterprise risk management program, which includes multiple stakeholders, policies, procedures and systems to routinely assess, quantify and manage strategic risks to the business. Some leading organizations have established a Global PFAS risk leader and steering committees, supported by external advisors and experts, to focus on this issue and manage it across the organization.

Identify potential PFAS-related risks - evaluate the current and historical operations, products and supply chains to assess whether PFAS may have been present. This should consider both intentionally added and unintentionally added PFAS, as well as supplies or materials used in the product manufacturing and facility operations, such as PFAS firefighting foam. PFAS-related data is often sparse or difficult to obtain, so data gaps should be noted as part of the identification process. A thorough assessment of the supply chain, including safety data sheets, supplier product information, supplier interviews, industry knowledge of PFAS-containing products, and fate and transport evaluations, are all necessary to help identify where PFAS may be entering your operations, whether intentionally or not, and where it may manifest itself.

Prioritize – screen the identified risk against your company’s risk tolerance and materiality criteria to prioritize the most significant risks. Materiality will differ between organizations - for some companies, such as consumer health product businesses, brand reputation may be most critical and the focus will be on PFAS in the supply chain and products, whereas for others, such as a business-to-business manufacturer, environmental liability may represent a more material concern and they may focus on more dispersive uses. The PFAS landscape is dynamic, so consider future regulatory and market context when prioritizing.

Materiality assessment requires stakeholder engagement spanning multiple internal functions (e.g., senior management, legal, EHS, operations, risk, product stewardship and supply chain, etc.), as well as external stakeholders (e.g., customers, regulators, community members and leaders, NGOs, etc.) depending upon the context, and partnering with trusted external advisors to provide technical, legal and regulatory expertise and bench strength across a range of disciplines (e.g., site investigation and remediation, product stewardship and regulatory affairs, supply chain analysis, communications and public affairs, and EHS compliance and management).

Develop a mitigation plan to address the most material risks using scenario analysis and feasibility assessments to determine the best path forward. With respect to products and supply chain, mitigation plans will require identifying, testing, evaluating and qualifying appropriate PFAS-free product substitutes. However, companies need to proceed deliberately to avoid potential regrettable substitution, for example by replacing a PFAS-containing material with one that is equally as regulated or scrutinized by the market. The investment of time and money to reformulate a product, establish new supply chains, reconfigure a manufacturing process and prepare the product for sale in multiple jurisdictions (registration, labeling, documentation, marketing etc.) is significant, so companies need to plan and budget for these transitions now.

In some cases, the scope and magnitude of the necessary transitions will be substantial enough that they will be transformative to the business – significantly altering the strategic enterprise – and will need to be managed as such. Some companies are electing to discontinue a product or business line all together due to the potential risk.

Recognize the dynamic context of PFAS-related risk - mitigation may be phased to enable adaptive management based upon the inflow of data (technical, operational etc.) and changing market and regulatory conditions.

Balance transparency and confidentiality - companies should proceed thoughtfully and deliberately with the above process, considering the balance between discovery, disclosure and transparency and maintaining confidentiality and legal protections. Engaging trusted technical, regulatory, and legal advisors into your team can help your company maintain an appropriate balance and enable you to leverage technical expertise and available legal and regulatory protections.

Where there is risk there is opportunity

While PFAS represents a complex and challenging business risk, where there are risks and challenges there are opportunities, such as an opportunity for product differentiation or securing preferential supply chain position.

Businesses that move quickly and purposefully and start updating their internal processes and procedures to allow for PFAS considerations into their new product offerings and operations (e.g., R&D, engineering, sourcing and procurement, manufacturing, M&A), will be better positioned to maximize the value of the opportunities while more effectively mitigating material business risks.