The business world faces many pressures to decarbonize, from new climate policies and regulation to investor expectations and shifting customer demands. Private market investors are also facing similar pressures and expectations from across their stakeholders. All of these expectations reinforce the need for decarbonization strategies to be a crucial part of portfolio company (PC) business planning.

However, there is a risk that these pressures can also inadvertently hinder decarbonization progress by leading to a compliance-led approach, which misses the opportunity to create value. Focusing on value creation is key to progressing and accelerating decarbonization at scale. Given the role and increasing influence of the private markets through their investments and PCs, the opportunity to create value though decarbonization represents an exciting and significant driver of positive change.

Value levers

A value-led approach to decarbonization requires key value levers to be assessed throughout the PC’s business planning process. These entail strategies and actions that are cost-effective and/or value-accretive now, as well as those which can be reassessed and potentially realised in the future.

This approach allows companies to assess their greenhouse gas (GHG) emissions abatement potential and establish decarbonization steps so that they can plan and prepare effectively.

Potential value levers include:

- Operational efficiencies, e.g., energy efficiency or electrification

- Procurement opportunities, such as creating cost savings through changed buying activities, e.g., bulk purchasing of green energy

- Market protection - being prepared for customer expectations and new market opportunities

- Cost of capital – reduced costs based on decarbonization performance

- Enterprise value – enhancement of value based on decarbonization trajectory and performance (both value protection and uplift on exit)

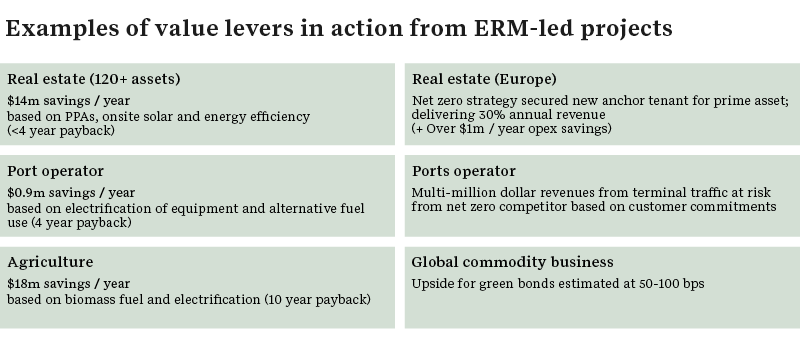

The graphic below illustrates examples of value creation that ERM has identified and realised when working with PCs and their investors.

Moving from compliance to value creation

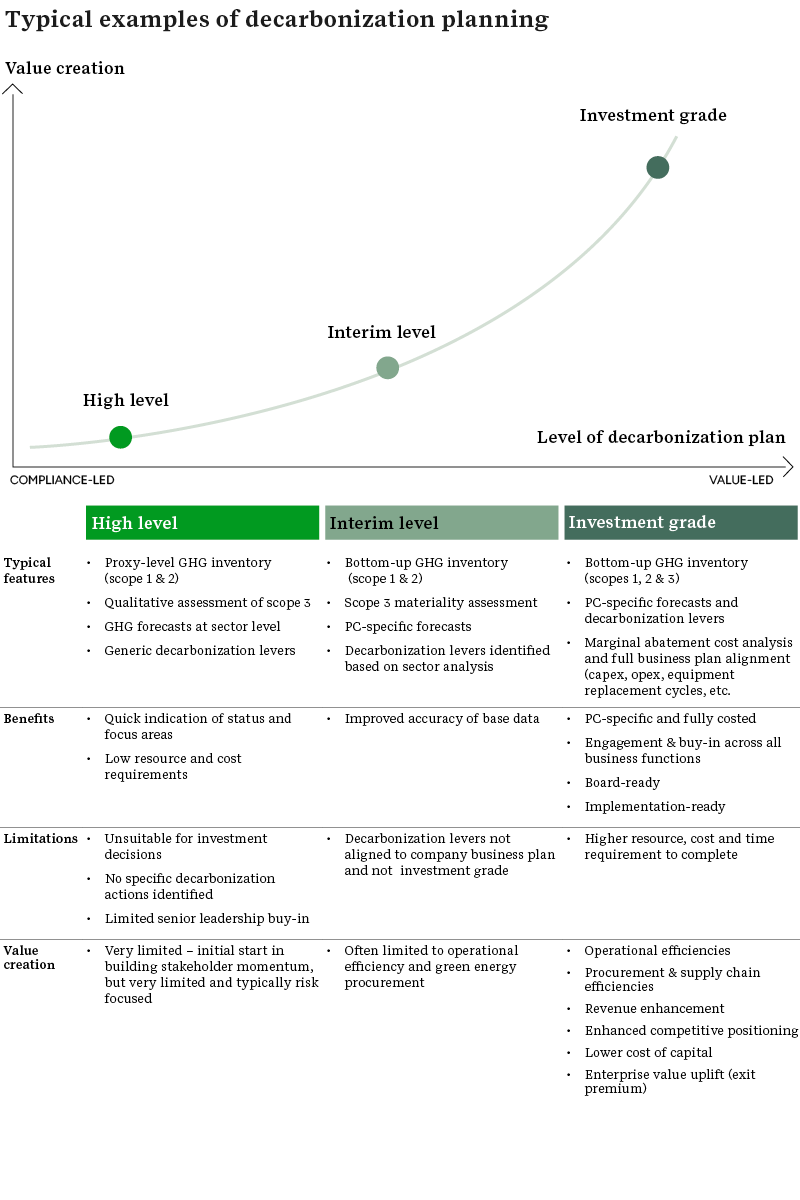

The chart below shows typical differences between compliance-led (high-level and interim-level) and an investment grade value-led strategy when creating a company decarbonization plan:

Whereas high-level and interim-level compliance-led approaches may provide cost effective and quick indications of GHG emissions status and hotspots, they have limitations when it comes to defining specific PC-level actions and seeking approval to invest and progress these. This often results in minimalist measures and encourages minimization of investment.

Whereas high-level and interim-level compliance-led approaches may provide cost effective and quick indications of GHG emissions status and hotspots, they have limitations when it comes to defining specific PC-level actions and seeking approval to invest and progress these. This often results in minimalist measures and encourages minimization of investment.

These compliance-led approaches offer limited opportunity for value creation, and as a result often hinder decarbonization actions because key stakeholders, such as PC leadership and investment teams, are not bought in to the need and value creation potential of decarbonization.

At the other end of the spectrum is investment-grade decarbonization planning, which encourages greater investment and innovation based on realising value. This approach is fully action oriented and value driven, routinely identifies value-accretive opportunities and ensures PC leadership is fully invested and committed to decarbonization. By breaking down and sequencing decarbonization into key value levers and meaningful steps based on GHG emissions abatement potential and value, it provides PCs with clear next steps and time horizons on which to advance decarbonization planning, actions and implementation.

Investment-grade planning

Investment-grade planning is by its very nature a more resource and time-intensive process than a compliance-led approach to decarbonization. However, ERM clients report that the value identified is frequently orders of magnitude greater than the costs of planning. Given that this level of detail will eventually be needed if a PC is to fully decarbonize, adoption of a value-led approach now can offer PCs a competitive advantage in capturing new market or investment opportunities. Value is uncovered and realised earlier and decarbonization (including whatever targets may be set e.g. net zero) have a greater likelihood of success and implementation, with direct upside for enterprise values.

The key considerations in an investment-grade planning approach are:

- Close collaboration between general partner investment teams and PC leadership to build the business case for comprehensive decarbonization. This creates buy-in, support and ownership for decarbonization.

- A bottom-up GHG inventory (Scopes 1, 2 & 3) built out using PC data and in close collaboration with PC teams. The more accurate the base data is, the more robust and reliable the subsequent investment analyses are, enabling quicker support and approvals.

- Future GHG trajectories and transition planning based on company-specific forecasts and supplemented by industry trends and insights. This is particularly important when considering market protection and growth opportunities which often link to decarbonization.

- Full business plan alignment (capital expenditure, operating expenditure, equipment replacement cycles, etc.), which is important to minimize decarbonization costs – for example, if fleet replacement is planned in 2028, there will already be a capex allocation at this point and so any investment in zero emission vehicles will be incremental.

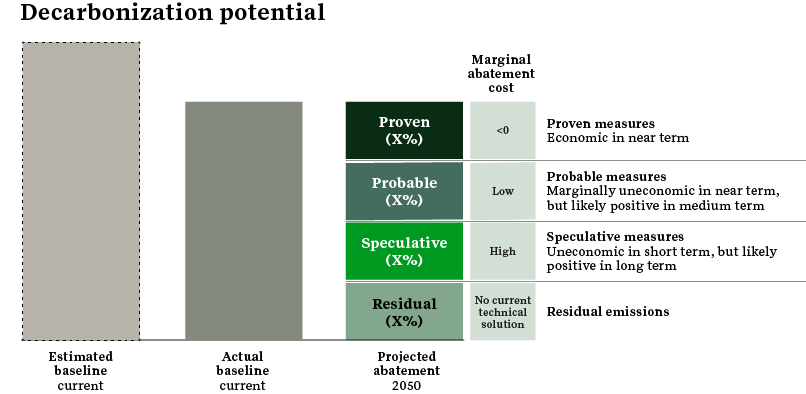

- Use of marginal abatement cost analysis so key sensitivities can be tracked over time and re-tested as needed e.g. as energy prices change, policy is updated or technology costs change.

These measures will allow PCs to analyse and grade decarbonization actions according to value creation potential, from proven to probable or speculative as in the example below:

The private markets are in a unique position to play a leadership role and drive decarbonization at scale and pace. To realize this opportunity, a value-led approach is essential, requiring investment-grade decarbonization plans to be developed and implemented as a priority. This will identify and realise value early, building further momentum and justification for additional decarbonization. Decarbonization need not be a compliance burden, but when approached with the right level of detail, is a value-creation tool now and into the future.

Contact the authors:

Peter Rawlings - Global Industry Leader, Finance

Peter.Rawlings@erm.com

Alaric Marsden - Consulting Partner

Alaric.Marsden@erm.com

Jag Bhangal - Associate Partner

Jag.Bhangal@erm.com