To respond to the emerging requirements driving climate-related financial quantification, companies must undertake new risk quantification methodologies, adapt business processes, and collaborate across key business areas. Delivering on these new undertakings will take time. However, with the right actions, companies can master these new mandates and come out ahead of competitors.

In our first blog on this topic, we explained the emerging requirements driving quantification assessments, and how companies can best prepare to respond to them. This second blog details the processes required to deliver the financial quantification outputs needed to comply with these requirements.

With the Task Force on Climate-related Financial Disclosures (TCFD) publishing their original disclosure recommendations back in 2017, early adopters have had several years to develop their climate-related disclosure approaches. As governments begin to mandate climate risk disclosures, others will need to rapidly mature their approaches to fully meet regulatory requirements. Although regulators are currently not prescriptive on the approaches that should be used, we recommend that companies pursue financial quantification by using external scenarios and models (e.g., from third-party providers), or by developing in-house modelling capabilities. The choice here will ultimately depend on a company’s needs, resources, and capabilities.

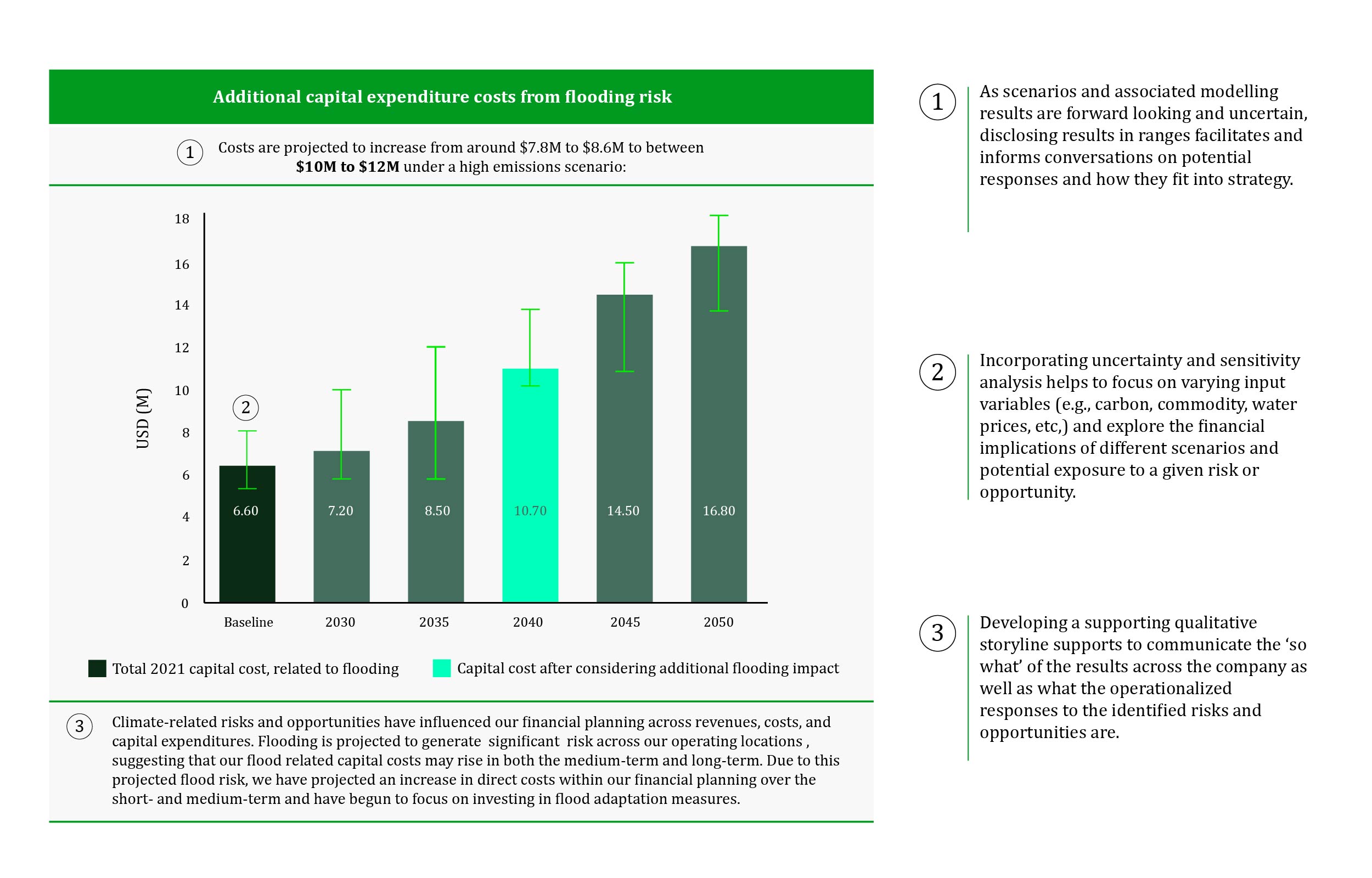

Despite the lack of a consistent market approach, there are numerous techniques that we believe are necessary to ensure that companies and their external stakeholders have a clear understanding of the process used and how they lead to quantified outcomes. These techniques are outlined in the examples set out in the figure below:

Embedding results into day-to-day processes: An exercise in cross-functionality

Although sustainability and risk functions have historically led to climate risk assessments, the move towards quantitative approaches requires an in-depth understanding of how climate-related impacts can play out. Coupled with the need to include results in financial statements and reporting, broader cross-functional approaches are now needed. As mentioned in our first blog on this subject, identifying and engaging a diverse stakeholder working group to guide financial quantification can help avoid challenges and support work to integrate assessment results into day-to-day processes.

To deliver an output that not only supports the disclosure of quantified climate-related issues, but also supports business planning and decision-making, we suggest including the following key business functions in the quantification process.

Undertaking the quantification of climate financial risks and opportunities has been crucial to better understanding the Genuit Group strategy which is centred around sustainability. One key success of the quantification process has been enabling the leadership team and Genuit board to review climate related risk and opportunities in quantified financial terms in the short-, medium- and long-term. For organizations starting this journey, it is critical to begin the risk and opportunity assessment and identification process with a view of translating those qualitative assessments into quantitative analysis.

An emerging practice: Integrating climate into financial statements

Once the various functions that will be involved in the financial quantification process are identified, it is imperative to consider how the outputs of the process can be integrated into financial statements. With upcoming requirements from the IFRS, the EU, the U.S. SEC, and beyond, the disclosure of material climate-related information is broadening from mainstream narrative reporting (i.e., the ‘front-half’ of annual reports), to financial statements (i.e., the ‘back-half’). For example, the IFRS standards require companies to incorporate material climate-related issues into financial statements and/or where there is a specific application of the standards (e.g., where climate change impacts financial performance).

Although climate-related issues may be critically important to a company’s future, there may be no visible impact on its financial statements, as these are not designed to predict future financial performance. The narrative reporting therefore complements financial statements by providing information that is likely to influence a company’s value over the short-, medium- and long-term, but has yet to meet the criteria to be disclosed in financial statements at the reporting date.

For financial statement preparers, key points to consider when starting integration are outlined below:

- Financial impacts should be clearly defined and their relevance to financial statements identified: Determine the financial impacts of the climate-related issues which have the potential to be material across time horizons. Identify where these financial impacts should be disclosed (e.g., Which line items do they impact? What may need to be reflected in the narrative reporting?)

- Develop a standardized approach to determine financial materiality: Assess the financial materiality of the climate-related quantification results, considering whether they have a quantitatively material impact on financial statements, or are qualitatively material. Being able to compare relative materiality across risks allows decision-makers in the business to make informed decisions and prioritize strategic activities within business planning.

- Align information disclosed in financial statements with narrative reporting: Investor decision making will consider both the front- and back-half of climate-related reporting. Therefore, assumptions and judgements used to prepare the back-half should align with information disclosed in the ‘front-half’ of a company’s financial reporting.

- Collaborate throughout the organization: To source data and incorporate a deeper understanding of climate-related matters, a variety of teams (e.g., finance, risk, sustainability, site teams, etc.) will need to participate in the financial quantification process and ensure appropriate consideration of climate-related matters in financial statements.

Financial quantification is a process not an event

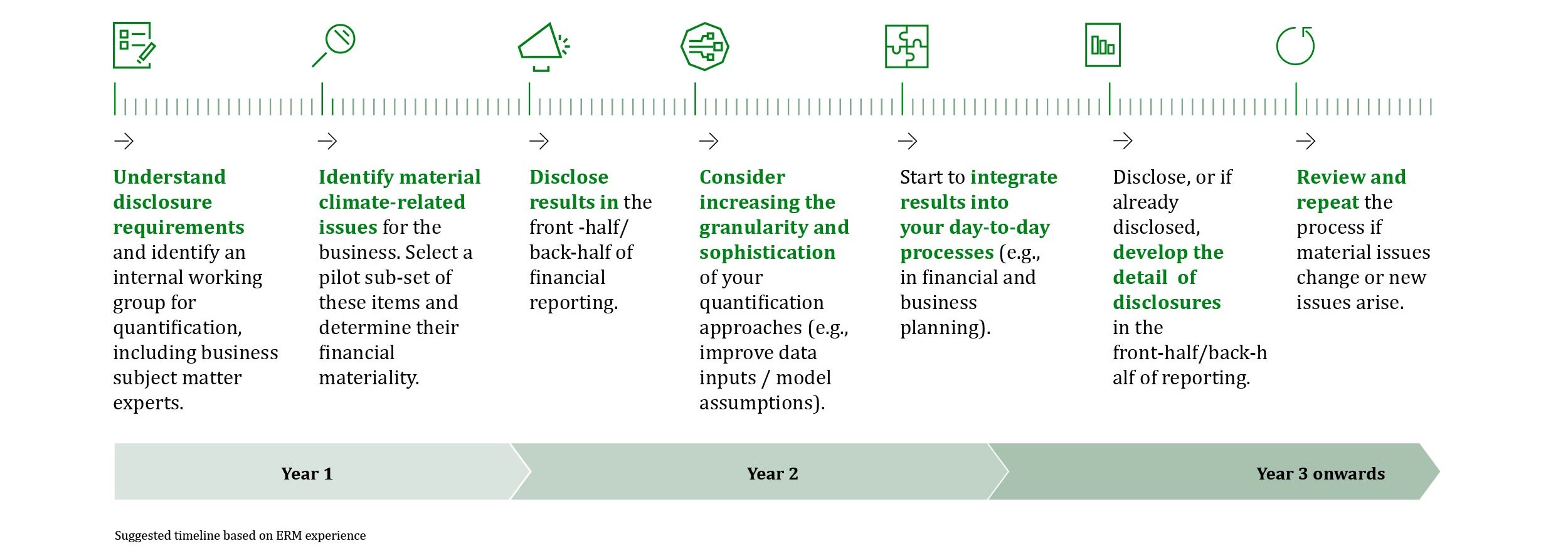

As the key consideration points outlined above show, it is important to consider the financial quantification process in a holistic sense, and although requirements to quantify and disclose climate-related issues are fast emerging, meeting these should be seen as an iterative process rather than a one-off event. To ensure success, organizations should spend sufficient time structuring their efforts, engaging stakeholders across a variety of teams, and gathering the key data and information required. Developing a realistic roadmap to quantifying and integrating material issues into financial reporting can help to guide these efforts. Like the implementation of the TCFD recommendations, it may take more than one reporting cycle for climate-related integration to meet the standard expected by investors and other stakeholders. A typical timeline of suggested steps for successful financial quantification is presented in the figure below:

A step-by-step method for success

When responding to the emerging requirements driving the financial quantification of climate-related issues, companies should take a bespoke approach that incorporates the particularities of their business. Although quantification may look different for each organization, there are common principles and techniques that companies can follow to ensure financial quantification is a success.

To ensure quantification results are clear for their business and external stakeholders, companies should:

- Incorporate uncertainty or sensitivity analysis to show variation in key input variables can impact results.

- Disclose results in ranges to not give a false sense of accuracy of the modelling.

- Develop an accompanying qualitative storyline to support understanding of the results by a wide range of stakeholders.

A cross-functional approach that engages a diverse stakeholder working group can help avoid challenges and support the integration of assessment results into an organization’s day-to-day processes. The business functions that should be involved in the quantification process include:

- Sustainability team members

- Risk team members

- Finance team members

- Site managers and operations managers

- Supply chain managers/representatives

When integrating results into financial statements, statement preparers should consider:

- Clearly defining climate-related risk and opportunities so that they can be easily matched to the relevant financial statement line items.

- Developing a standardized approach to determine financial materiality so that they can compare relative materiality across risks for decision-making and financial planning.

- Aligning information disclosed in financial statements (front half) with narrative reporting (back half) of climate-related reporting.

- Collaborating throughout the organization to incorporate a deeper understanding of climate-related matters across different parts of the business.

Although requirements to quantify and disclose climate-related issues are fast emerging, meeting these should be seen as an iterative process rather than a race. Developing a realistic roadmap to quantifying and integrating material issues into financial reporting can help companies realize a successful financial quantification process, ensuring that all stakeholder expectations for its results are met.