A surge in mandatory climate disclosures and lagging global emissions reductions has put decarbonization in the spotlight. This makes ERM’s proprietary frameworks for understanding what drives the energy transition and how companies can effectively decarbonize more relevant than ever.

On the eve of the UN global stocktake, during the United Nations (UN) Climate Change Conference (COP) in Dubai, one thing is crystal clear: the world’s emissions trajectory remains far off track to meet the Paris Agreement’s goals, and all stakeholders need to ramp up their decarbonization efforts if we want to keep 1.5oC, or even 2oC warming in sight. At last year’s COP, ERM presented its framework to help guide private sector decarbonization efforts - The Decarbonization Imperative: An Executive Primer - which hasn’t lost any of its urgency.

In last year’s executive primer, ERM shared its thinking on how policy developments, stakeholder and shareholder pressure, and the evolving understanding of climate risks and opportunities are shaping the decarbonization expectations of companies. We also created a blueprint for companies, from defining their strategy to integrating the latest technologies and financing mechanisms.

These two frameworks continue to provide helpful guidance for companies as they face pressure to decarbonize faster, reduce negative impacts, and increase positive contributions to local communities and the economy more broadly.

In this article, we revisit the two frameworks while highlighting developments in 2023 that make a structured corporate approach to decarbonization more pressing than ever.

Decarbonization Drivers: Regulators and Shareholders Keep Raising the Bar

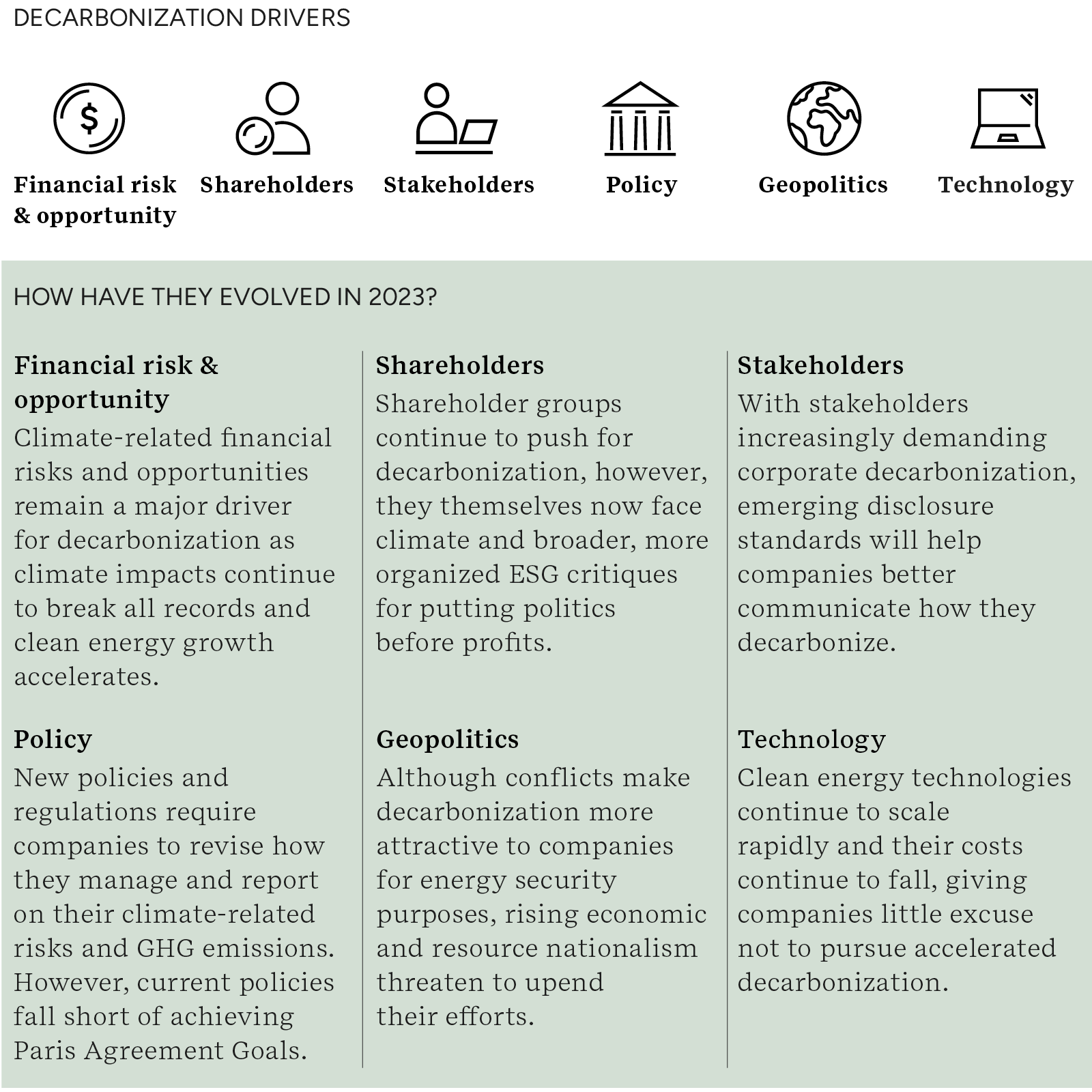

In the Decarbonization Imperative, we outlined six climate uncertainties that serve as the biggest drivers of corporate decarbonization. Although much has changed in the past year, these drivers continue to shape expectations and actions by companies.

While all six drivers have evolved, three of them have undergone the most significant changes.

Shareholders are increasing focus on collective action even among continuing anti-ESG backlash: With the financial risks of climate change becoming ever more apparent, even as anti-ESG sentiments continue to be felt around the world, investors are increasing their focus on corporate decarbonization. As they look to protect against climate risk and secure returns, many are turning to collective action. One of the most notable moves came from the Net-Zero Asset Owner Alliance who in March 2023 issued a requirement to its members to make no new investments in upstream oil and gas infrastructure. As more shareholders consolidate their influence to push for corporate decarbonization, companies are likely to face little choice but to accelerate their climate action or risk losing out on a key source of capital.

Despite collective action progress, the anti-ESG backlash remains a major force. Political pressure has pushed more than half of insurers in the Net-Zero Insurance Alliance (NZIA) to leave. To stop the exodus, the NZIA removed requirements for members to set or publish greenhouse gas (GHG) emissions reductions. Although politically charged pushback is having real impact, its long-term effect on shareholder efforts to accelerate corporate decarbonization is likely to be limited by simple economics in that climate change’s bottom-line impact is becoming too big to ignore.

Climate disclosure rules take a leap: Stakeholder expectations and policy requirements have also evolved considerably over the past year, most notably in the disclosure space. In June, the International Sustainability Standards Board launched its first global standard for voluntary sustainability disclosure. Of the two standards released, S2 focuses on climate.

In Europe, the Corporate Sustainability Reporting Directive came into force in January 2023 mandating detailed climate, nature, and social impact disclosures. The CSRD requires companies to disclose their strategies to ensure their business model is compatible with limiting global warming to 1.5°C. Across the Atlantic, the U.S. policy landscape is also shifting after California enacted policies requiring large companies operating in the state to disclose their Scope 1, 2, and 3 GHG emissions and their climate-related financial risks. The emergence of mandated disclosure will likely accelerate corporate decarbonization as it will require companies to more closely evaluate the success of their climate strategies and to account for all their emissions, which will make it easier to identify decarbonization opportunities.

Geopolitics, resource nationalism, and wars continue to shape the energy landscape: Geopolitics and its impact on decarbonization efforts are increasingly on the minds of companies, especially as wars rage in Gaza and Ukraine. Both conflicts have the potential to destabilize the global energy system due to their connections with some of the world’s largest energy producers. Fortunately, one of the most cost-effective strategies to achieve energy security comes from clean energy sources. While Russia’s invasion has led to record oil prices, it has also helped spur financing for renewable energy, with annual clean energy investment growing by 24 percent between 2021 and 2023 (compared to only 15 percent for fossil fuel investment).

Beyond conflict, growing economic and resource nationalism are complicating decarbonization efforts too. For instance, Indonesia and Zimbabwe have banned exports of critical minerals key to electric vehicles and other clean energy technologies. The rise in protectionism seen globally is likely to slow down corporate decarbonization as companies struggle to procure the inputs and products they need to reduce emissions.

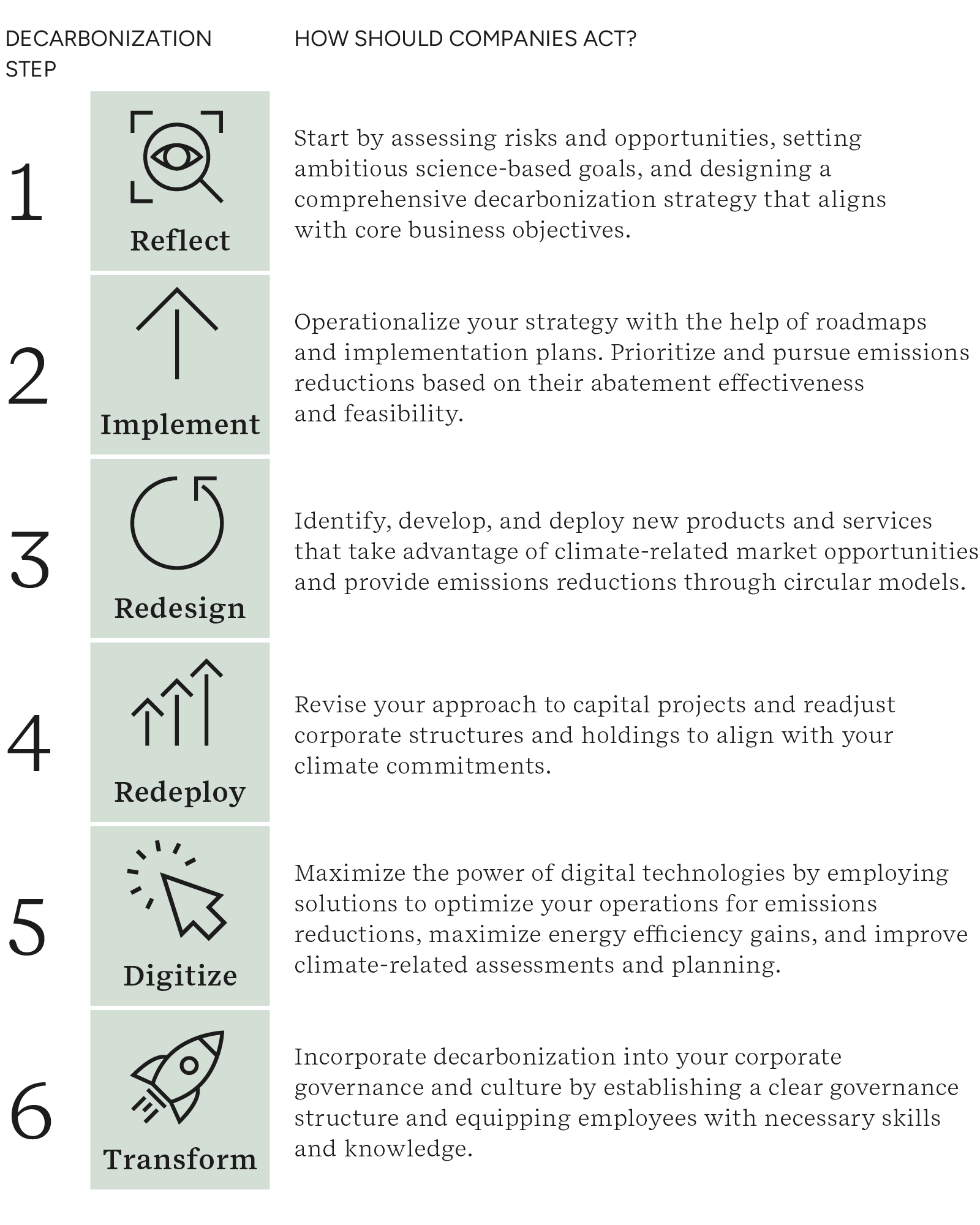

Companies Should Follow Six Essential Steps for Effective Decarbonization

As the external drivers evolve, our framework of six essential steps continues to serve as helpful guidance for companies on how to navigate any scenario. When companies adopt the blueprint – from climate strategy and goals, through opportunity prioritization and operational implementation, to product and service redesign and portfolio adjustment, through digital enablement and the change management necessary to support employees and maintain a resilient culture – they will find themselves well set up to accelerate their decarbonization efforts and better prepared for the uncertainties of today and tomorrow.

Social issues become a major factor shaping decarbonization decisions: While historically the focus for decarbonization has primarily been on the E and G issues of ESG (Environmental, Social, and Governance), the prominence of S issues have risen rapidly as social considerations are starting to shape decisions in all six phases outlined in the decarbonization framework.

The social dimension touches almost every aspect of energy transition – from human rights in the supply chain, to equitable access to renewable energy, to rights of communities where major capital projects are being developed. “Just transition” is an important concept emerging in the global dialogue, defined by The International Labor Organization as “Greening the economy in a way that is as fair and inclusive as possible to everyone concerned, creating decent work opportunities and leaving no one behind”. Human rights concerns in supply chains in particular feature prominently in decarbonization conversations, given the high geographic concentration of materials critical to renewable energy technologies and electric vehicles in countries with high human rights risks.

While integration of social considerations may require additional time and resources, from a business value perspective, social acceptance from communities, employees, and stakeholders can translate to talent attraction and retention, productivity, access to capital and new to markets.

In one example that demonstrates the rising prominence of social issues, ERM is working with companies and governments to address social issues in decarbonization of Ukraine’s energy system. To achieve its GHG emissions reduction goals, the Ukrainian government is shifting away from coal, a move which requires creation of decent work and quality jobs for the workers employed in mines. ERM worked with the Ukrainian government to develop a regeneration framework for two mine sites, employing around 1,000 miners and their surrounding communities.

In another example, ERM worked with Kitikmeot Corporation and the Government of Nunavut to develop a strategy to support the Inuit workforce in the major projects sector. This work involved Indigenous engagement and multi-party collaboration in the western part of Nunavut, a northern territory within Canada.

Advances in technological solutions are expanding decarbonization options: While many technologies have made a leap in the past year, hydrogen and carbon capture and storage (CCUS) in particular have seen rapid advances, making them commercially more appealing and easier to scale. Hydrogen in particular has had a blockbuster year and seen record investments. In one of the largest investments in clean manufacturing and jobs by any nation, the U.S. Administration has announced that it will invest $7billion to launch seven Regional Clean Hydrogen Hubs. Developing nations are also accelerating investments in hydrogen with India and Africa beginning to develop their own hydrogen markets to address local energy needs and attract international investment. Meanwhile, the announced capacity of CCUS has soared by more than 50% in recent years and is expected to grow by at least 18% annually. While these technologies will not provide silver bullet solutions to all challenges, they will enable faster decarbonization of many sectors and in particular hard-to-abate industries such as steel, cement, chemicals, and energy.

To access the full report about decarbonization drivers and company response framework, read The Decarbonization Imperative: Executive Primer.