As originally published on 8 March 2021 on Watershed Partners corporate site

Against the backdrop of uncertainty and unprecedented economic and social change that unfolded in 2020, there has been a significant shift in the integration of environmental, social, and governance (ESG) factors into investment decision-making. As a business approach, ESG generates long-term value by controlling risks and capitalizing on opportunities associated with environmental and socioeconomic issues. This value can be both created and protected, and can be measured in terms of financial, operational, intellectual, reputational, human and/or natural capital.

We’ve witnessed a material change in the level of sophistication and understanding of the importance of ESG, and the risks and opportunities it poses to the mining sector. It’s no longer just enough to tell a great story about a significant discovery or great production numbers. It’s equally important to demonstrate how you’re working alongside local communities, and how you’re contributing to the low carbon economy transition and to the responsible sourcing of prime materials.

In 2020, ERM and Watershed Partners partnered to host a dialogue session on ESG and mining that generated provocative ideas and big questions that began to unpack the opportunity ESG transparency provides the sector.

As the first quarter of 2021 comes to a close, we want to continue this dialogue and share 3 questions that could shape the future of ESG and mining in Canada.

“I” beyond ESG: How do we incorporate Indigenous indicators into ESG criteria?

The resource sector in Canada has a unique obligation to proactively engage with Indigenous communities. The risks of failing to consult early and often are well understood—in fact, there’s a graveyard of projects that have lost investment or failed regulatory reviews for not doing so. At times, consultation is merely risk avoidance; something more is needed to pursue opportunities that produce strong outcomes—and these robust opportunities to engage Indigenous communities don’t fall neatly into “social” or “governance” indicators, even though they improve outcomes for both.

The recently published primer, Indigenous Sustainable Investment: Discussing Opportunities in ESG by the First Nations Major Projects Coalition, frames the challenge succinctly:

The challenge for investors is that the vast majority of existing ESG standards do not include the rights and interests of Indigenous peoples, and have been developed in the absence of Indigenous input and buy-in. This exclusion has significant negative ramifications for Indigenous peoples and Canadian investors alike.

This is not to say that Canadian mining companies are not addressing Indigenous interests and priorities. Understandably, most ESG frameworks focus on broad indicators over domestic contexts, which means that they often lack the flexibility to be able to address local, or even country-specific, risks and opportunities; ultimately, that’s a loss for everyone involved.

In a world of heightened awareness around the need for reconciliation, inclusion of Indigenous peoples, and the need to end systemic racism, the rise of the “I” (for Indigenous) in ESG will impact everything from the access to and battle for capital, right through to a company’s future brand perception.

So how can we fortify the “S” in ESG through an Indigenous lens? How will any changes impact communities, investors, and mining companies? What does “fair development” or “real benefits” for Indigenous communities look like in practice?

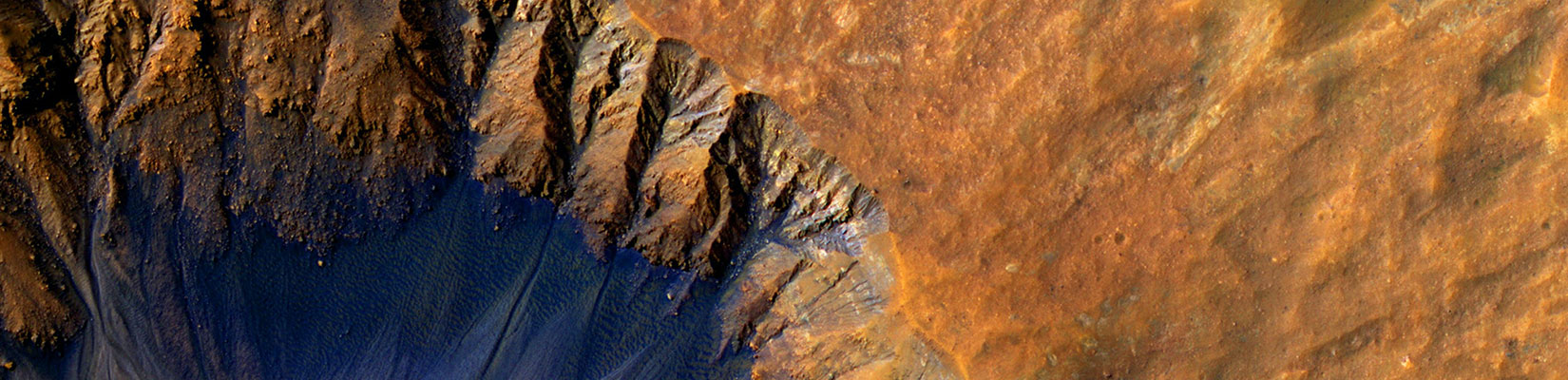

The mine investors want to see: Are traditional measures of environmental performance still the right ones?

There is a tremendous upside to rethinking how the sector manages land, processes and transports materials, and generates human and social capital. Much is being done by mining companies in these areas, but when the traditional ratings of ESG performance adopted by most don’t fully consider these opportunities, we fall into the category of what we call “defensive sustainability.” This is primarily motivated by value-protection and driven by risk management, many times focusing too narrowly on monitoring negative impacts on air, water, etc., and less on value creation.

For a clearer picture of ESG value creation, measurement of ESG needs to evolve beyond traditional environmental impact metrics, and better reflect what’s material across the entire project lifecycle—from concept to closure. What performance gets measured during operations should look different than what’s measured during closure.

For example, stakeholders, especially investors, want reassurance that closure is being fully considered throughout the mine lifecycle, and that sufficient financial resources have been set aside to fund plans to successfully relinquish the mine to become a useful benefit. Today’s leading mining companies are better integrating sustainable biodiversity, decarbonizing operations, and proactive reclamation into their initial mine designs, from construction to closure. This produces new ways of planning and operating, and should factor into access to long-term capital and stakeholder support.

Moving forward, how can investors and companies alike move beyond defensive sustainability? And what reassurances need to be put in place at the concept and design stages to ensure major environmental challenges are considered at the start of a project?

ESG & diversity and inclusion: How can diverse governance promote growth?

Corporate diversity and inclusion has emerged as a pressing topic in parallel to, and as a part of, broader ESG considerations. Within the mining industry, efforts are being made to create more inclusive environments, equitable processes, and talent pipelines, but there’s further work to do.

One component to corporate diversity and inclusion that moves the dial forward is board governance and ensuring that there’s diverse representation within the highest levels of leadership. A recent report from the Michael Lee Chin Family Institute for Corporate Citizenship, 360º Governance: Where Are the Directors in a World of Crisis?, argues that extractive industries, such as the mining industry, must embrace and pursue diversity amongst their leadership to ensure their operations play a part in securing a sustainable future for all.

One key takeaway is that boards should understand their social impact and act with a clear corporate purpose at the outset of any planned project. A board’s composition should also reflect a diversity of thought, perspective, and lived experiences. This is also a position that Nasdaq recently pushed forward, by mandating all Nasdaq-listed companies to publicly disclose board-level diversity statistics through their proposed disclosure framework.

Frameworks of this kind can better facilitate an increase in diversity at the highest level of decision-making. And it should go without saying that increasing board diversity does not upend the pursuit of profit—it actually supports it. Diversity opens up new and necessary opportunities for innovation and financial growth.

This point is fleshed out it in the 360º Governance report:

Attention to ESG issues is associated with superior financial performance; companies that adopt formal sustainability policies and those with higher ESG ratings that tie specifically to material impacts have better financial returns than their peers. In addition, firms with better board governance—those that have established processes for stakeholder engagement, disclose ESG metrics and tie executive compensation to these metrics—outperform their counterparts over the long term in terms of stock price, lower cost of capital and returns.

Ultimately, increasing pressures to improve board diversity and representation are not only coming from communities impacted by board-level decisions, but are also coming from institutional investors looking to maximize the impact of their dollars through an ESG lens.

While there is a great deal of public and industry interest around the need to increase diversity in organizations, what does this look like in action for mining companies on their own, unique paths towards corporate diversity and inclusion? What clear, shared measures need to be put in place to ensure that diversity and inclusion are embedded in each operational and organization layer?

Where do we go from here?

The recent tidal wave of public and private interest in ESG marks a real opportunity for the mining industry to reassess how it shows up and impacts the transition to a low carbon, equitable economy. Although delivering on promises to reduce carbon, improve diversity, and innovate with new ways of working poses a challenge for the industry, it also creates opportunity. Increased demand for critical materials that support the low carbon economy transition will turn a spotlight on the mining industry, making it important for all mining companies to work together on solutions to protect and create value in this transition.

Watershed Partners is a collaborative design firm that facilitates multi-interest alignment toward shared outcomes. In times of change and opportunity, we bring people together to find common values, build healthy relationships, and collaboratively design resilient outcomes.