Over the last few years, climate-related issues including the pursuit of net zero have risen to the top of the sustainability agenda in corporate boardrooms. While reducing greenhouse gas emissions is a critical priority for business, so too is the need to preserve natural systems and biodiversity. Increasingly, the climate and nature agendas are recognized as intertwined, even interdependent. And, as with climate change, 2030 presents key deadlines for ambitions like the determination of multiple countries to protect 30% of land by 2030, the success or failure of which will influence the success or failure of other future biodiversity efforts.

Why the nature agenda matters so much right now

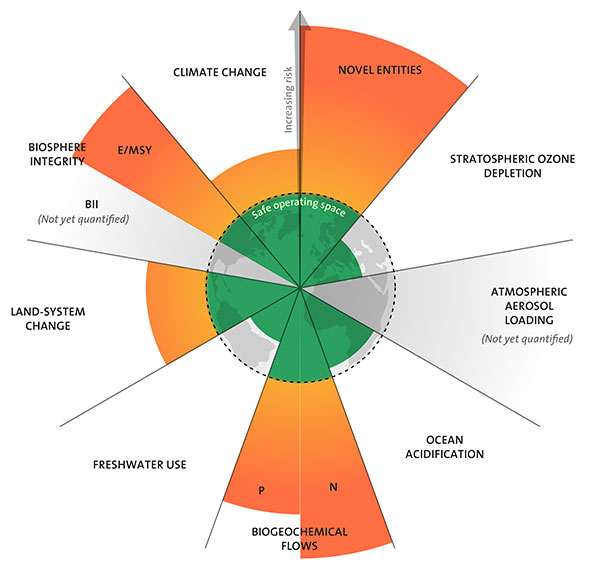

Biodiversity goals have been given greater urgency than ever before by the Dasgupta Review, an independent report on the economics of biodiversity. The review discusses the planetary boundaries framework, a concept that presents a set of nine biophysical processes critical for Earth System functioning and boundaries (i.e., limits) that define a safe operating space for each one. Each boundary crossed is a step closer to planet-wide destabilization and potentially unprecedented operational risk for businesses. Alarmingly, 2022 saw the fifth and sixth boundaries breached.

Credit: Designed by Azote for Stockholm Resilience Centre, based on analysis in Persson et al 2022 and Steffen et al 2015.

Operational risk aside, nature-first approaches to business can protect and preserve vast economic value. According to the World Economic Forum (WEF), some $44 trillion – more than half – of the world’s total current GDP is either moderately or highly dependent on nature. Complementing this, research from the World Wide Fund for Nature (WWF) suggests that the total value of natural assets amounts to at least $125 trillion every year – including land productivity, pollination by insects and this figure also includes the knowledge and cultural value of intact nature to communities and indigenous people.

One way to address net zero and nature is for organizations to ground their strategies in nature-first models and decarbonize their operations through approaches that protect, restore, and sustainably manage nature. This has the potential to reduce a company’s impact on the climate at the same time as mitigating the impact of the climate crisis on the company, strengthening the resilience of both the ecosystem and the organization.

Understanding your impact on nature – and nature’s impact on your company

As a first step, organizations need to understand their current impact on nature and biodiversity. This can be achieved by borrowing many of the techniques already used in Environmental and Social Impact Assessments (ESIA). Whereas ESIAs forecast the environmental and social impact of a proposed future project, here the goal is to apply the method to activities affecting nature and biodiversity today.

Companies undertaking such assessments are rewarded with the insight required to develop concrete recommendations for avoidance and conservation, restoration, and the compensation of biodiversity. Nestle's Forest Positive strategy, which commits to moves beyond managing deforestation risks in their supply chain, is first looking to understand and address the drivers of deforestation for key forest-risk commodities. This work also forms part of their Net Zero Roadmap. In another example, in June 2022, P&G announced a comprehensive strategy to help build a water positive future as part of their Ambition 2030. The strategy includes a new 2030 water goal to restore more water than is consumed at P&G manufacturing sites located in 18 water-stressed areas around the world. ERM’s work with P&G on a Water Risk Assessment framework helped identify the sites and create appropriate water stewardship action plans.

By conducting scenario planning exercises to explore physical risks, organizations can understand how potential climate change impacts will affect nature and biodiversity. This will help expose where their facilities, supply chains, and capital assets are open to risks such as sea-level rise, flooding, heat wave, drought, hurricanes, etc. For example, a typical physical risk enquiry designed to help develop a nature-first approach might include biodiversity assessments for a portfolio of operating sites and assets across a corporate value chain examining raw materials extraction, production, refining, and retail.

Zeroing in on your supply chain

A nature-first approach to net zero protects businesses from natural hazards at the same time as protecting nature from overuse. Organizations building a net zero strategy will already be looking at their supply chain to understand and measure Scope 3 emissions.

An increase in natural hazards affecting supply chains is coinciding with other major disruptions putting global supply chains under strain such as geopolitical instability and energy price inflation. Businesses across a broad range of sectors including agriculture, fast-moving consumer goods, pharmaceuticals, mining, oil & gas, and energy are paying more attention to their reliance on intact and resilient ecosystems and stepping up efforts to ensure sustainable sourcing of products

What this scrutiny makes clear is the importance of biodiversity and complex ecosystems as supporting elements of risk management procedures across the supply chain. Resilience built by implementing nature-first strategies can provide a competitive edge as supply chain shocks continue, both shoring up a company’s supply chain and signaling greater stability to partners.

What quality nature-first solutions in net zero strategies look like

Nature-first solutions move away from approaches that merely reduce harm to nature to ones that have a positive impact. This might mean sustainable agricultural systems in place of overreliance on inorganic fertilizer and pesticides like maintaining indigenous species and creating new natural vegetation buffers around and through plantations and agricultural systems, or creating nature-based solutions around facilities (e.g., using vegetation to reduce flooding).

Walmart has been something of a pioneer in this space, adding roof rainwater harvesting systems on all new stores in the U.S. and recycling of grey water for non-critical uses. Unilever is working to eliminate fossil fuels in cleaning products by 2030 by replacing synthetic-derived surfactants / detergents for cleaning products with Rhamnolipid. Resulting products have already been launched in Chile, and Unilever will soon roll-out this type of large scale production in Europe.

Carbon offsetting has a significant role to play in nature-first approaches too. First, carbon offsetting can be used to positively impact nature in areas of interest (e.g., those that are aligned with the supply chain). Second, projects may be chosen to provide nature-positive benefits (e.g., vegetation for flood resilience, water retention, biodiversity, etc.).

For instance, planting trees for shade by fields can act as a carbon store and provide shade for sensitive crops. In the UK, National Highways (as Highways England) uses GIS mapping of all the trees on their land, works with local farmers to maintain and enhance biodiversity along these strips of land, and claims the carbon offsets resulting from the trees. Elsewhere, some water companies are installing floating solar PV arrays on major reservoirs that generate renewable power while reducing water evaporation losses.

Measuring to ensure impact

Nature-first solutions will only yield optimal results if measured and improved over time. ERM is playing an active role in piloting and testing measurement methodologies for this emerging area. We are closely involved with the Capitals Coalition and WBSCD working groups contributing to developments such as the ALIGN method.

ALIGN augments the ‘Transparent’ methodology, an output of the EU LIFE funded Transparent project created to standardize natural capital accounting and valuation principles for business in line with the ambition of the European Green Deal. Where Transparent covers standardized natural capital accounting and valuation principles for business with a focus on air, water, and land, ALIGN will develop these principles through complementary guidance focused on biodiversity.

The main outputs of ALIGN will be proposals for standardized, biodiversity inclusive, natural capital management accounting practices, as well as a set of generally accepted methods, indicators, and criteria for biodiversity measurement and valuation. Nature-based targets can be more complex than traditional net zero targets like greenhouse gas emissions goals and will vary between sectors and individual businesses. When looking to set KPIs, businesses should consider looking to see what work has already been done in the sector and/or partner with experts who can help define the best goals and metrics for them.

Nature-first is the future

The move towards nature-first solutions and business processes is gathering momentum. Nature-first approaches are increasingly linked to the ability of businesses to attract investment. Soon, businesses will face demand to disclose nature-based risks through the Taskforce for Nature-related Financial Disclosures (TNFD), a new framework modeled intended to help financial markets understand the link between nature and company performance, and to encourage them to channel investment to companies that follow a nature-first model.

Nature-first approaches are inextricably linked to the net-zero agenda; without one, the other will prove impossible. Businesses able to incorporate both will find they are better able to meet their sustainability goals while also putting their operations on a much stronger footing.