Corporate climate and nature goals are inherently linked. Climate change and nature loss have similar drivers–forest clearing, for example, degrades biodiversity and increases GHG emissions. Climate change and nature also interact with one another–biodiverse soils sequester more carbon, while rising temperatures weaken soil’s ability to sequester carbon. And solutions for climate change and nature loss are linked–restoring ecosystems on land or in oceans increases biodiversity and enhances potential carbon sequestration.

Because of these connections, good corporate climate strategies need strong nature components. The timescales involved in climate change mitigation drive climate action to the top of corporate priorities, but measurement of nature risk has only recently risen to a similar level of quality as is available for climate. “Natural capital accounting” (NCA) helps companies measure the state of nature and manage nature-related risks and opportunities.

Recently NCA has demonstrated its reliability for measuring biodiversity, water, and other aspects of nature. Moreover, these refined methods are aligned with financial accounting standards. While the shift to leading NCA practices can appear daunting, companies can adopt them in steps, extracting value at each. As a result, a company could get immediate value from simply reorganizing its biodiversity data with NCA methods. Overtime, this process promises to deliver more robust valuations of material nature-related risks and opportunities.

Current practices

Climate change, land conversion, pollution, invasive species, and natural resource overconsumption are found to be increasing the nature-related risks and opportunities companies face. As risks and opportunities grow, companies are building methods to measure their nature-related impacts and dependencies and how they give rise to risks and opportunities.

These methods range from impact assessments to life cycle assessments to greenhouse gas emission calculations. However, research by the Capitals Coalition has noted that because of the diversity of methods used by companies, data generated by them cannot be readily compared, is difficult to consolidate, and cannot be audited.

Consider a theoretical mining site. Permitting may require that an environmental impacts assessment capture data on the physical range of endangered species or extent of threatened habitats and the impact the future mine’s operations will have on them. A life cycle assessment aiming to measure the environmental impact of the extracted minerals conducted on the same mining site may measure species richness or ecological functions. A community impact assessment may measure the likely decrease in grazing and foraging opportunities. The challenge lies in consolidating these measures even at a single site, not to mention measuring net impact across multiple locations.

Natural capital accounting and its refinement

In response to these bottlenecks, natural capital accounting has risen in prominence.

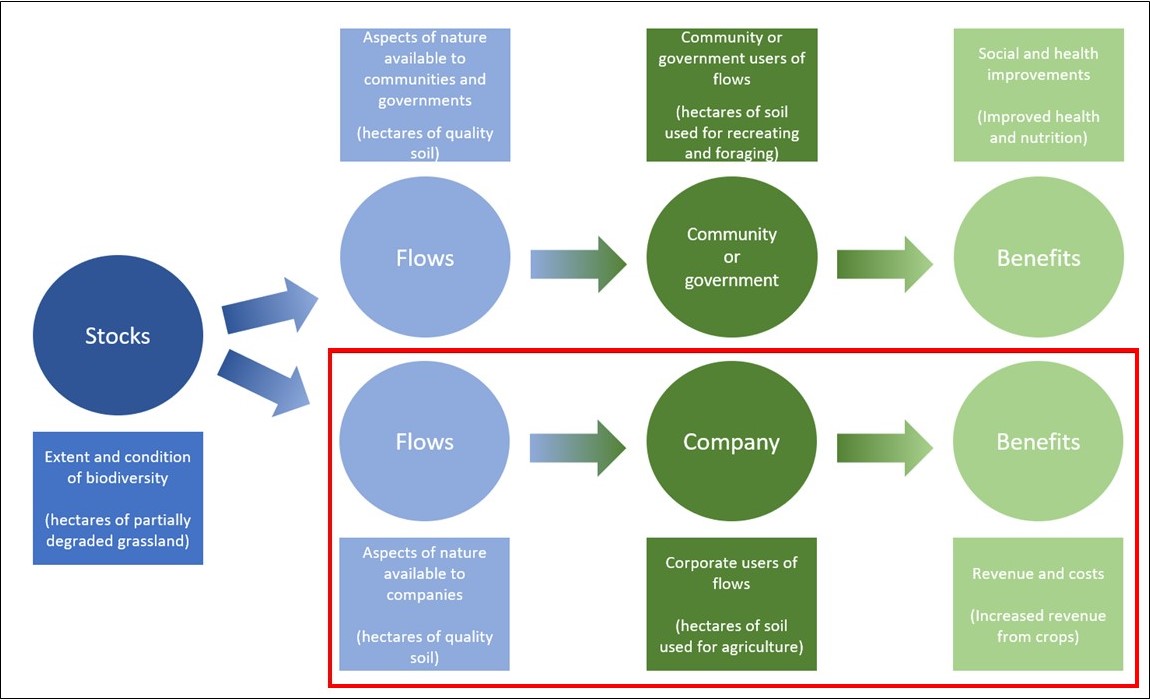

NCA is broadly understood as the measurement of (1) the state or stocks of nature and (2) the flows of benefits to people and organizations. In Figure 1, the section in the red box shows a stock of grassland, which creates a flow of available soil that a company uses for revenue-producing agriculture. This same stock of grasslands can also provide for recreation or foraging opportunities, yielding health and nutritional benefits for communities. While this form of NCA is effective at helping companies measure how changes in the state of nature impact their financial performance and other risks, it does not fully addressed issues of data comparability, consolidation, and auditability.

Figure 1: Stocks and flows of ecosystem services

In recent years, “corporate natural capital accounting” (CNCA) has emerged to address challenges related to data comparability, consolidation, and auditability that NCA does not solve. Put forward by the Capitals Coalition and picked up by the UNEP/WCMC-led and European Commission-funded effort, Align, CNCA embraces the language, systems, and structures of financial accounting (see Box 1). It draws heavily from the United National System for Environmental Economic Accounting (SEEA) and the Biological Diversity Protocol (BD Protocol) while being informed by the broader range of NCA work. By following CNCA guidance, companies can create data that is comparable and auditable and that can be consolidated across an organization (e.g., multiple sites).

|

Box 1: Definition of corporate natural capital accounting (CNCA) From the publication Time to Take Stock (TTTS) CNCA is the systematic process of identifying, measuring, recording, summarising, and reporting the periodic and accumulated net changes to (a) the biophysical state of natural capital assets and (b) the associated values of natural capital to business and wider society. CNCA requires:

|

Creating data that is comparable and auditable and that can be consolidated starts by getting the stock data—the direct measures of biodiversity—right. Once collected and properly organized, this stock data becomes more interoperable than what other biodiversity assessment methods (e.g., impact assessment, life cycle assessment) allow.

For example, CNCA, when focused on land ecosystems, uses “condition adjusted hectares”, often called “habitat hectares” or “quality hectares” for measuring impacts on land ecosystems. These are created using a condition rating system composed of numerous biodiversity metrics. The metrics in a condition rating system result in a scale (e.g., 0.0-1.0, or 0-5) that is used for weighting. For example, 100 hectares of boreal forest in pristine condition would be calculated as the product of the extent of forest (100 hectares) [multiplied?] by its quality (1) i.e. 100 X 1.0, or 100 quality hectares. Should the quality of the forest degrade 10 percent because of an invasive tree species, the condition score might drop to 0.90 and the forest would now reflect 90 condition adjusted hectares (100 X 0.90).

This condition adjusted hectare can also be used to:

- Set targets – offsetting impacts to 1.5 condition adjusted hectares

- Determine costs – restoration costs to 1.2, 1.5, and 2.0, and costs of maintenance. These costs can be specific to a geographical location.

- Providing investors with risk profiles – a site reduced to 0.4 and improved to 1.5 with complementary regulatory compliance information

- Apply to other applications (e.g., developing corporate targets, compliance reporting, tracking performance)

In short, CNCA is more interoperable than NCA alone (Capitals Coalition 2022). Without CNCA, data collected for one business application is often more challenging to repurpose in another. Moreover, CNCA allows data to be integrated across sites, allowing a company integrate condition-adjusted scores for all their sites into a single corporate net impact figure.

CNCA uptake is growing rapidly. Sibanye-Stillwater and Eskom have published their full methods and final accounts, and BHP has pledged to do so. The attention the Taskforce on Nature-related Financial Disclosures (TNFD), the Science Based Targets for nature (SBTs for nature), and the Global Biodiversity Framework (GBF) are receiving is driving this uptake by spotlighting the risks and opportunities that arise from corporate impact and dependency on nature. These pressures will continue to intensify.

Practical first steps

Building a full CNCA system within a company requires new expertise, IT systems, and resources as well as a long-term view. However, there are practical steps to get started today to not only get more immediate value from the company’s nature data but also to start the process of building a full CNCA system. These steps will help ensure that early efforts will not need to be replicated in the future.

ERM recommends that companies:

- Update corporate policies to embrace the TNFD, SBTs for nature, and the Kunming-Montreal Global Biodiversity Framework with the Biological Diversity Protocol or Time to Take Stock (TTTS) to guide monitoring methods.

- Develop a registry of natural capital assets for all corporate owned and operated land. Described in the BD Protocol and TTTS, a registry lists every ecosystem type, its extent and condition as well as the populations of material species. Many companies already have this data, though it is often in numerous bespoke documents and databases. Should the company have data gaps, initial registries can be built and data collection next steps can then be prioritized.

- Use the registry to develop condition-adjusted accounts (see BD Protocol and TTTS). These accounts help create a single number for the vegetation and material species of every site, business unit, or entire company.

- Use the accounts to assess risks and opportunities. Here too, the BD Protocol, TTTS and a growing body of case studies and guide provide direction. For example, the TNFD suggests several metrics for measuring physical, regulatory, reputational, and other risks.

- Use the accounts to report on progress, whether for internal reporting to finance departments or executive teams or external reporting to regulators and communities. No matter the use, CNCA yields data that can be readily understood by non-experts.

These pragmatic steps will generate immediate benefits from the data produced today and help a company prepare for the future. The condition-adjusted accounts noted in step 3 above will provide a unit of measure that can be used for most business applications (e.g., risk analysis, cost-benefit analysis, compliance reporting, and disclosures). The data can be used later to develop statements of performance and position, build data management software, and improve monetary valuations of corporate assets.

Conclusions

The five steps above put companies on the path to CNCA.

Regardless of their long-term visions, companies are already collecting and managing nature-related data for compliance, site management, and supply chain risk assessment. Using ERM’s five recommendations will not only extract more value today but prepare firms for tomorrow’s regulatory and commercial environments. The adage of measuring what you manage, while true, is incomplete. It must also be measured well and support a firm’s full decision-making needs from biodiversity management and financial risk analysis to net-zero roadmap development.

Resources

- For a briefing on the benefits of CNCA and technical information it implementation, see the Capital Coalition’s Time to Take Stock.

- The Biodiversity Disclosure Project’s Biological Diversity Protocol is a guide to implementation.

- Valuing Nature: The Case for Nature-Related Assessment and Disclosure, a report by the Capitals Coalition and the SustainAbility Institute by ERM.