Impact with clients

Sustainable path forward at DIF Capital Partners

DIF Capital Partners – a fund manager that invests in a wide range of international, high-quality infrastructure projects that currently manages around €5.7 billion of assets – embarked on a project with ERM to better understand and improve the environmental, social and governance (ESG) performance of its investments.

The resulting program has created an approach that contributes positively to the local communities while delivering returns for investors. It proves that action-oriented engagement and flexibility are key to an effective sustainability strategy.

With a 2020 target to achieve an A+ score from the Principle for Responsible Investment, DIF turned to ERM for advice in defining an ESG policy, assessing its current investments and developing an ESG framework to govern the company’s approach moving forward.

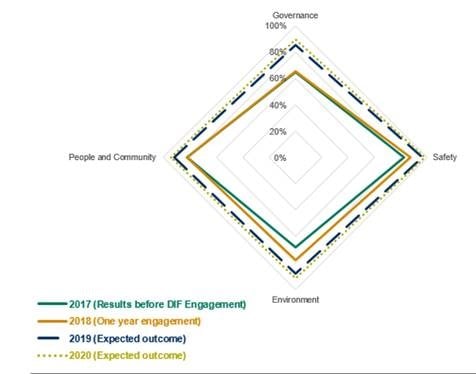

As a first step, DIF expanded its focus to five ESG focus areas: environmental, people and community, government, safety and climate resilience. To gain a full understanding of the sustainability impacts of its current assets, DIF and ERM developed a focused survey to set a baseline. A follow-up survey in 2018 revealed measurable improvements triggered by the 2017 engagement.

The survey results were used to develop the ESG Path: mutually agreed objectives and action plans for each individual asset. Each asset’s ESG Path includes a framework for action with goals, actions and timeframes; best practices to share with other assets; and a flexible and focused approach that varies based on the maturity of the asset and sector.

Ongoing engagement with assets is critical for success. For example, in 2019, ERM facilitated a conference that brought together a variety of stakeholders to discuss ESG initiatives and share best practices among DIF's road assets.

Furthermore, ERM and DIF worked together to develop an ESG screening tool for new investments and interactive training modules to support DIF staff in using this and other ESG tools. The tool and training continue to build internal capacity to enable DIF’s deal team to quickly identify potential ESG elements throughout the due diligence process and guide investment committee members to ensure new investments are aligned with DIF’s ESG strategy. For example, ERM developed a Climate Change Heat Map to perform high-level screening of the main physical and transitional climate-related risks that DIF assets, or potential opportunity assets, are exposed to.

DIF also worked with ERM to align its ESG objectives with the Sustainable Development Goals (SDGs). This process involved a high-level review of the 40 assets participating in the ESG Path. We examined how these assets interact with each SDG goal, and mapped this against DIF’s five ESG focus areas, internal operations and targets. DIF identified seven priority SDGs that its work most directly contributes to, and also looked at how its own business and corporate culture aligns with the SDGs.

Highlights of ERM’s contributions to ESG initiatives are presented in the DIF 2019 ESG report: Digging Deeper on Sustainability.

Note: This case study is excerpted from The Path that Leads to ESG by Angela Roshier, partner and head of asset management at DIF Capital Partners, and Alastair Scott, ERM partner, published in the November 2019 issue of Infrastructure Investor.