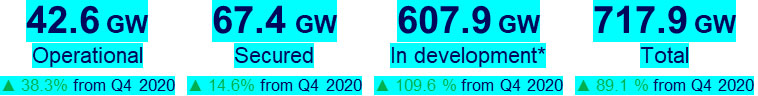

Against a backdrop of renewed focus on energy security and the transition to low-carbon energies, new research from The Renewables Consulting Group (RCG), an ERM Group company, finds that global offshore wind development capacity grew 89% in 2021. More than 200 GW of new offshore wind projects were announced in both established markets, such as the United Kingdom and Netherlands, and new markets, such as Italy and Australia.

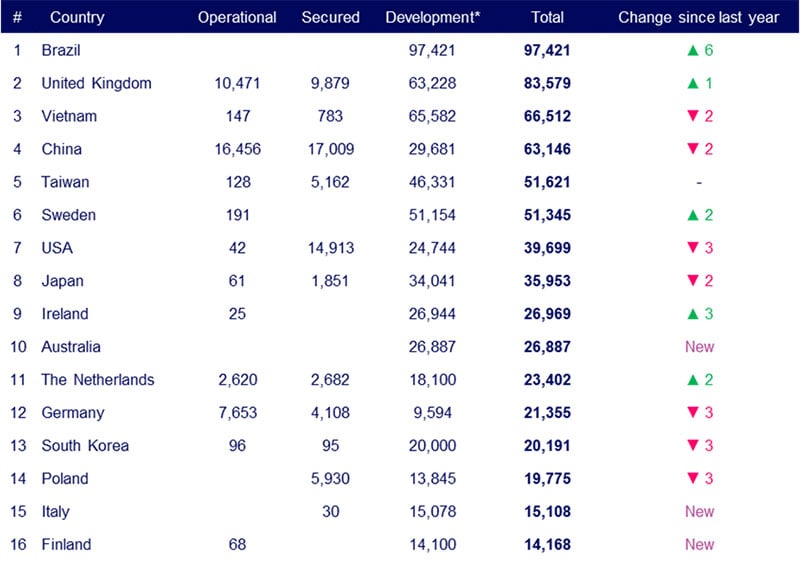

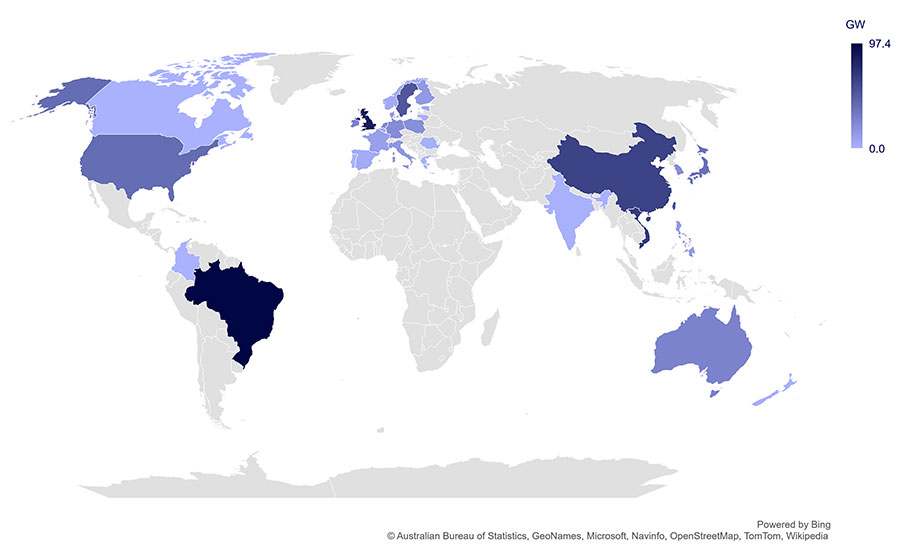

According to RCG’s 2021 Global Offshore Wind Annual Market Report, there is also a new No. 1 in the global rankings as Brazil moved to first place with a total surpassing 97 GW, all in development.

*As of April 1, 2022

Source: RCG’s Global Renewable Infrastructure Projects (GRIP) database

The United Kingdom, with 10.5 GW operational and 9.8 GW secured, ranks second with 83.6 GW total. Vietnam, with 65.6 GW in development, continues its massive pipeline. Ranking fourth is China, which installed a record breaking near 8 GW of capacity throughout 2021 and surpassed the United Kingdom to become the largest operational offshore wind market. China’s growth through 2020 and 2021 is, in part, driven by the expiry of the feed-in tariff at the end of 2021. Taiwan rounds out the top five with a total of 51.6 GW.

Notably, Australia (#10), Italy (#15) and Finland (#16) are new entrants among the world leaders and signify the growing popularity of offshore wind as a viable option to support the transition to a low-carbon economy.

The predominant theme, however, was leasing activity – particularly across Europe. Scotland allocated almost 25 GW of capacity in the Scotwind process, its first offshore leasing round in a decade. The first contract for differences (CFD) round for offshore wind projects took place in Poland, with 5.9 GW of capacity securing a route to market. The first new auction for projects under Germany’s offshore wind act also occurred. The first commercial-scale floating wind project auction in France was launched. Many more auction firsts are to be expected in the coming years, as the groundwork was laid for future site allocations in Spain, Greece, Italy, Norway, Ireland and Lithuania.

Allocation activity was not limited to Europe, however. In the Asia Pacific region, Japan’s first offshore wind auctions took place, securing a route to market for 1.7 GW of capacity. Rules were refined for the long-awaited Round 3 auctions in Taiwan, clarifying local content requirements and available development areas. Further south still, the Australian government detailed the permitting process required for projects to obtain seabed exclusivity throughout the development lifecycle of an offshore wind farm.

In the Americas, The US Department of the Interior’s Bureau of Ocean Energy Management (BOEM) announced it would hold up to seven new offshore wind lease sales by 2025 in the New York Bight, off the coasts of the Carolinas, California and Oregon, as well as in the Central Atlantic, Gulf of Mexico and the Gulf of Maine.

The lease auction for the New York Bight area concluded in early 2022 with six areas totalling more than 488,000 acres. At $4.37 billion in bid revenue, the lease auction results were the highest-grossing competitive offshore energy lease sale in history, including oil and gas lease sales. Also in 2022, Taiwan is launching its third auction round for zonal development, with up to 3 GW of capacity. The upcoming tenders are expected to be highly competitive due to the fact there is a far larger amount of capacity in development than will be awarded subsidies.

New project leasing has been underpinned – and in some cases driven – by an incredible expansion in the global development portfolio. Markets such as Brazil, Italy, Spain and Australia have been pushed to draft and ready offshore wind leasing and development frameworks in response to proposals for tens of projects competing for seabed areas and grid connection points.

Other markets, such as Colombia and the Philippines, have recognised the need for more formal development processes earlier in the respective market maturation, issuing offshore wind frameworks after a smaller number of project announcements.

Total offshore wind portfolio (GW)

Commenting on the Global Offshore Wind: Annual Market Report, Andrew Cole, RCG Partner and Global Practice Lead, said:

"The findings contained in this year's Offshore Wind Global Market Report clearly demonstrate the importance of offshore wind on a global scale. Several leasing opportunities have culminated in developers securing routes-to-market – bolstering marketplace confidence amongst governments, institutions, investors and developers. With offshore wind continuing to emerge in new markets, it is clear that many decision-makers envision offshore wind is as the key fulcrum in their low-carbon energy ambitions.” – Andrew Cole, RCG Partner and Global Practice Lead

RCG’s full analysis and forecasts can be viewed in its Global Offshore Wind: Annual Market Report. The 200-page summary includes details on each offshore wind market with analysis of the resources that will allow projects to reach route to market, financial close, and commissioning milestones. An overview of the global supply chain is also provided. To purchase a copy of the Annual Market Report, visit thinkrcg.com/data-services/.

About The Renewables Consulting Group, an ERM Group company

RCG, an ERM Group company, is a specialized expert services firm supporting the global renewable energy sector. From strategy to implementation, the company serves businesses, governments, and non-profits around the world with technical and management consulting services for both mainstream and emerging renewable energy technologies. RCG works with the public sector, private equity and financial services firms, utilities and project developers, equipment manufacturers, and engineering and construction companies for on- and off-shore wind, solar, and emerging technologies including wave and tidal and energy-storage projects. RCG is headquartered in London, and has offices in New York, Tokyo and elsewhere. Learn more

About ERM

ERM is the business of sustainability.

As the largest global pure play sustainability consultancy, ERM partners with the world’s leading organizations, creating innovative solutions to sustainability challenges and unlocking commercial opportunities that meet the needs of today while preserving opportunity for future generations.

ERM’s diverse team of 7,500+ world-class experts in over 150 offices in more than 40 countries supports clients across the breadth of their organizations to operationalize sustainability. Through ERM’s deep technical expertise, clients are well positioned to address their environmental, health, safety, risk and social issues. ERM calls this capability its “boots to boardroom” approach - a comprehensive service model that allows ERM to develop strategic and technical solutions that advance objectives on the ground or at the executive level. Learn more

View all

View all